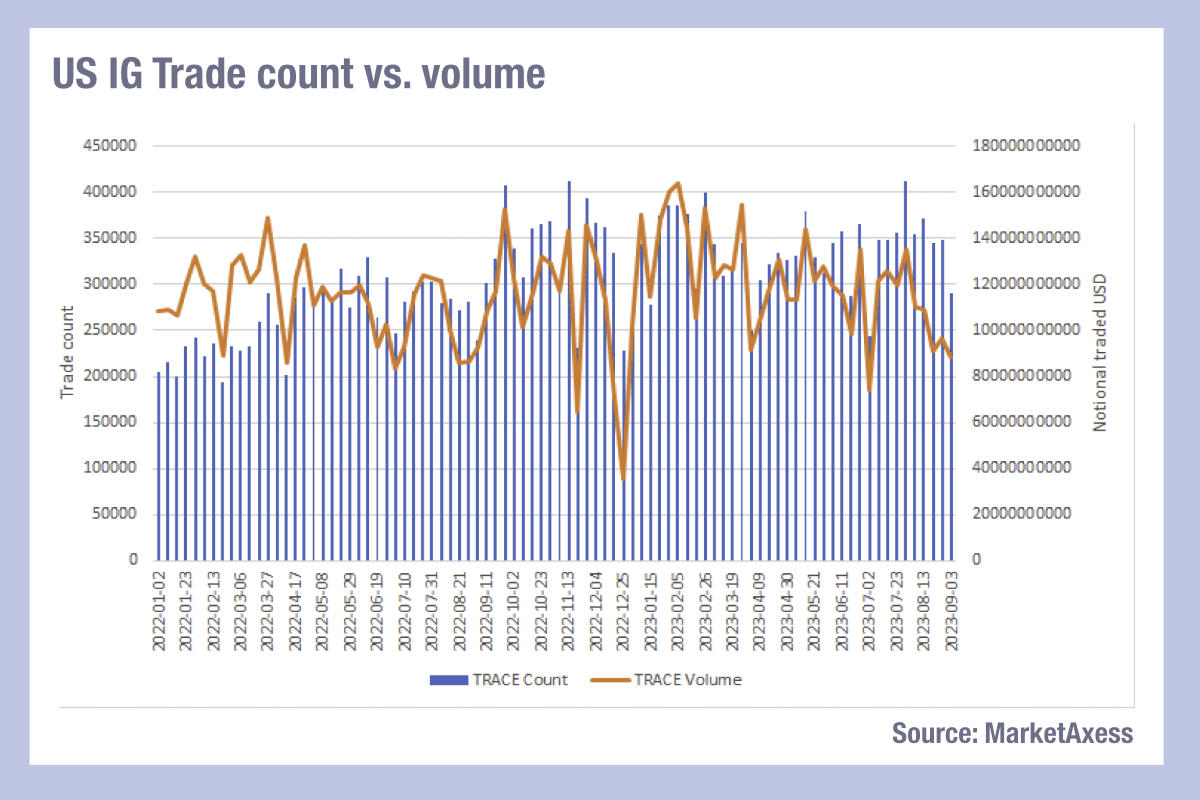

The fires of summer are being replaced by the floods of autumn, but in the bond markets a gentler and more positive outcome is being see to the change in seasons. Looking at data from MarketAxess Trax, which tracks activity across multiple fixed income markets and sources, we can see that trading volumes appear to be recovering from their summer lull, as trading desks fill with returning holiday makers.

Looking more closely the real story here is that trade counts are up, while volume by notional has fallen somewhat. Volumes are only half the story for liquidity, as while they might indicate greater activity, liquidity has another metric – the price of accessing it.

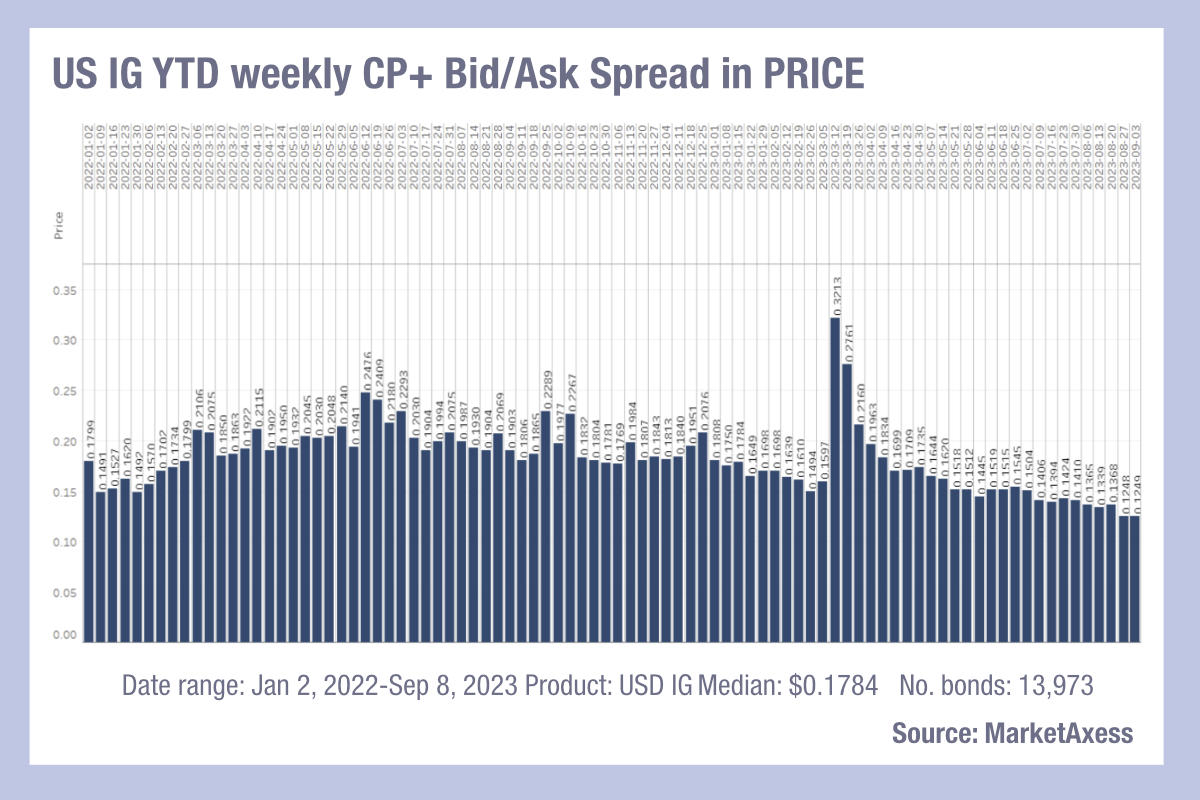

Thankfully we can also see from the MarketAxess CP+ bid /ask spreads for US investment grade bonds, measured by price, that these have been tightening, with the average hitting $0.16 down from $0.2bps in June.

As bid-ask spreads fall, notional falls and trade count goes up, the net appearance is of a market which is seeing many more trades of falling sizes being executed. In this instance the greatest difference between notional/count seen this year is occurring, potentially meaning that average trades are at their lowest size this year.

Trading in such small size speaks to the success of automation and algorithmic trading and paints an interesting liquidity picture for firms seeking out larger block trades.

Once again, the value of pre-trade analysis is key here in supporting traders understand the landscape in trading even very liquid credit.

Source: https://www.fi-desk.com/have-us-ig-trades-hit-their-smallest-size-this-year/