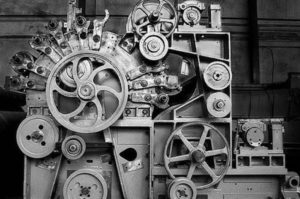

Meet the Technology Companies Automating Capital Markets

In an effort to cut costs and make internal processes more interesting, U.S. investment banks are busy trying to automate the process of doing deals. Source: efinancialcareers First they came for the equities traders and the FX traders. Then they came for the CDS index traders. Now, it seems, the computers are changing the jobs of people working in M&A…