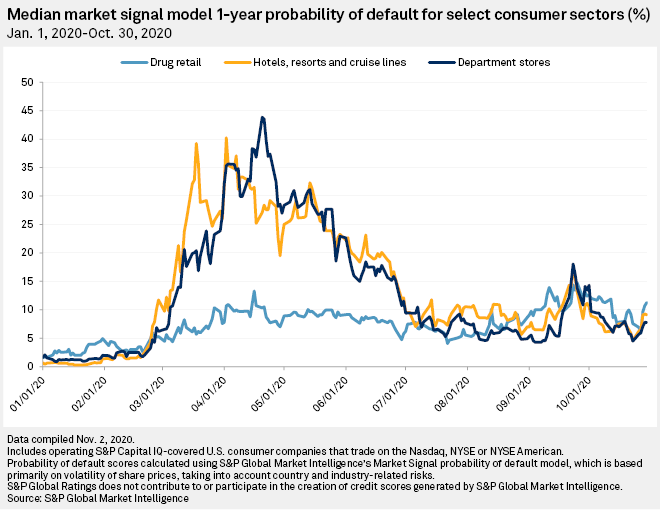

The risk-of-default ratios for consumer industries have decreased from higher peaks earlier this year, but they are still trending above the levels they enjoyed before the coronavirus pandemic.

Source: S&P Global

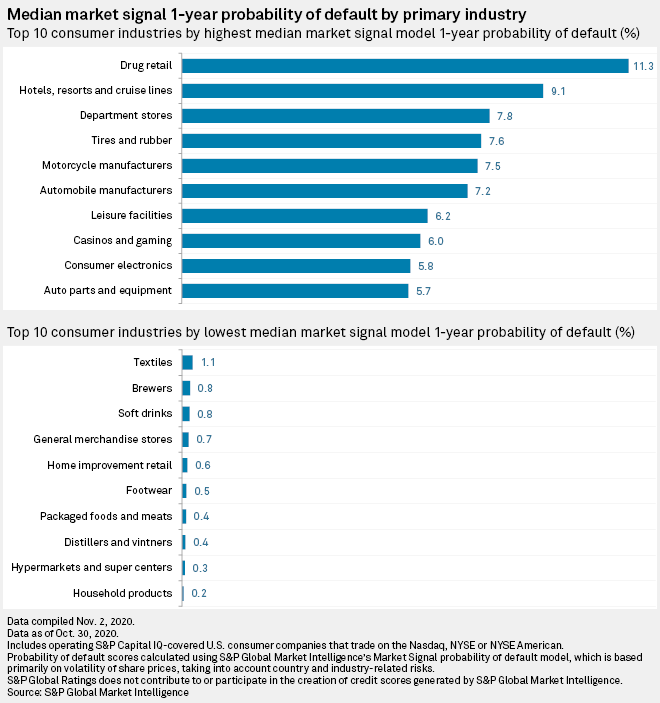

Drug retailers, department stores, and the travel and leisure industries — considered the most vulnerable sectors by S&P Global Market Intelligence’s median one-year market signal probability of default model — still carry a higher one-year probability of default than they did before the onset of the COVID-19 crisis.

The probability-of-default score for U.S. drug retail companies was 11.3% at the end of October, down from its 14.8% peak on Sept. 25 but still above the 2% level at the beginning of the year. The figures represent the odds that a company will default on its debt within the next year based on fluctuations in the company’s share price and other country- and industry-related risks.

Drug retailers such as Walgreens Boots Alliance Inc. and Rite Aid Corp. have posted double-digit declines in their share price year-to-date through Nov. 3. Walgreens, which on Oct. 15 reported a 28% year-on-year decline in fourth-quarter adjusted diluted EPS, is down 36.6% on the year, while Rite Aid is down 35.9% on a year-to-date basis.

CFRA Equity Research analyst Arun Sundaram said in a note Oct. 31 that his 12-month outlook on the drug retail sub-industry is negative, citing several headwinds. He predicted a slow cough, cold and flu season with more people staying at home or wearing masks in public. He also cited higher costs due to employee bonuses, safety expenses, and the fact that consumers are delaying doctor visits over the coronavirus crisis.

Meanwhile, Moody’s said in an Oct. 19 report that drugstores including Walgreens and Rite Aid will likely see a 10% decline in operating income in 2020.

The probability-of-default score for the travel and leisure industries has fallen to 9.1% as of Oct 30, down from a peak of 40.2% on April 2. But the figure is still up from below 2% in January.

The sector is among the industries worst hit by the coronavirus pandemic. Most of the biggest stocks in the sector continue to trade in negative territory on a year-to-date basis.

Among cruise lines, Carnival Corp. & PLC and Royal Caribbean Cruises Ltd. were down 73% and 48.22%, respectively, this year as of Nov. 3.

The U.S. Centers for Disease Control and Prevention lifted its cruising ban Nov. 1 and replaced it with a conditional sail order, saying it will take a “phased approach” to resuming cruise ship passenger operations in the U.S. However, cruise industry group Cruise Lines International Association on Nov. 3 said its members, including Carnival and Royal Caribbean, will continue the voluntary suspension of their cruising operations through the end of this year.

Hotel stocks such as Marriott International Inc. and Hilton Worldwide Holdings Inc. are also down on a year-to-date basis. Rating agency S&P Global Ratings on Oct. 1 removed Marriott’s ratings from CreditWatch but affirmed its BBB- issuer credit and senior unsecured ratings on the company with a negative outlook.

“The negative outlook reflects significant risks from the ongoing pandemic and economic recession, and the likelihood we could downgrade the rating if a medical solution to COVID-19 is not achieved in mid-2021 or broadly disseminated by late 2021 in a manner that enables business and group travel and hotel demand to recover sufficiently for Marriott to restore credit measures in 2022,” Ratings said.

Hilton Worldwide on Nov. 4 reported a third-quarter loss of 28 cents per share. The company’s CFO Kevin Jacobs said on a post-earnings call the same day that the quaterly results reflect the continued reduction in global travel demand due to the COVID-19 pandemic.

Overall, the risk of default also fell for department stores. It stood at 7.8% as of Oct. 30, down from above 40% in April when the coronavirus pandemic forced stores to close their doors. The figure, however, is still up from 2.1% in January.

Macy’s Inc., which is trading down 61.24% on a year-to-date basis, in September reported a narrower-than-expected loss for the second quarter as comparable sales declined by more than 30% year on year. Other department store stocks like Nordstrom Inc. and Kohl’s Corp. are also down on the year.

Moody’s in an Oct. 19 report said it expects department stores, among other retailers, to bear the brunt of the coronavirus pandemic but post the “most pronounced” growth in 2021. Companies like Macy’s, Nordstrom and Kohl’s will likely see operating profit rise over 500% next year, Moody’s said.

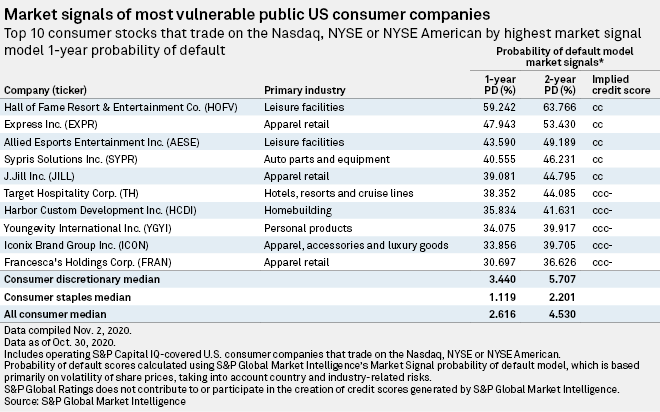

Resort, entertainment and media company Hall of Fame Resort & Entertainment Co. and homebuilder Harbor Custom Development Inc. are among the U.S. consumer companies with the highest vulnerability scores, according to Market Intelligence’s model.

As of Oct. 30, Hall of Fame Resort & Entertainment had a 59.24% chance it could default within the next year. Harbor Custom Development’s probability of default score was 35.83%.

The homebuilder began trading on the Nasdaq on Aug. 28 and raised gross proceeds of about $12.2 million in its IPO. Its share price has fallen by roughly one-third since its IPO.

Hall of Fame Resort & Entertainment and Harbor Custom Development did not respond to requests for comment on this story.

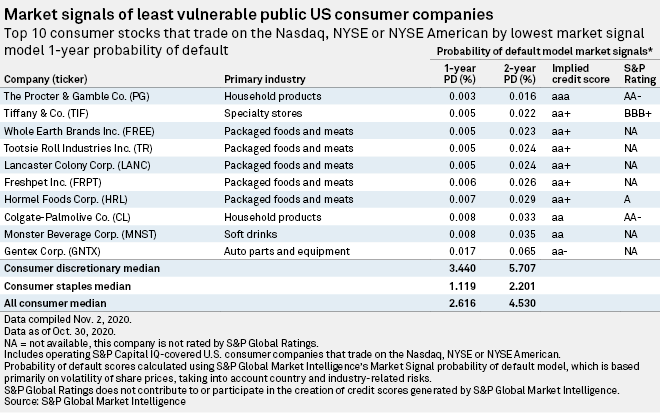

Meanwhile, companies like The Procter & Gamble Co., Colgate-Palmolive Co. and Tiffany & Co. are among the companies least likely to default within the next year.

Procter & Gamble and Colgate-Palmolive did not respond to a request for comment, while a spokesperson for Tiffany directed Market Intelligence to the company’s second-quarter results.

The jeweler reported fiscal 2020 second-quarter EPS that fell more than 70% year on year but surpassed analysts’ expectations. Shares of the company are down nearly 2% on a year-to-date basis as of Nov. 3.