![]()

“Overbond has helped us aggregate our disparate data sets into a consolidated view. They have layered their comprehensive AI analytics to enable us to make financing decisions with more precision and confidence.”

– Ali Suleman, Vice President and Treasurer, Hydro One

Source: Overbond

Overview

Hydro One Limited is an electricity transmission and distribution utility serving the Canadian province of Ontario. It is the largest electricity transmission and distribution service provider in Ontario, distributing electricity to nearly 1.4 million customers. The utility works with the transmission and distribution network by connecting generating facilities operated by Ontario Power Generation, Bruce Power and several other privately-owned companies. The generators produce and deliver electricity from their hydroelectric, natural gas, wind, solar and nuclear facilities to businesses and households across Ontario.

In November 2015, Hydro One Limited became a publicly traded company on Toronto Stock Exchange. Its wholly-owned subsidiary Hydro One Inc. has CAD$12.445 billion of outstanding bonds as of April 2020.

Hydro One’s Challenges

Hydro One had several challenges when it came to monitoring its credit spreads and those of its peers in order to issue bonds in the most cost effective manner. These pain points included:

1. Large amounts of fragmented new issue and secondary spread data from many dealers submitted in various formats that required manual preprocessing

2. Numerous data sources across e-mails in various formats, often without a “consolidated” view option

3. Manual processing required for timely benchmarking. This task was challenging due to intra- day capital market movements, especially during times of heightened market volatility

4. Processing times that engaged personnel and system resources

By working with the Overbond Treasury Debt Capital Service and automating its data intake and analytics, Hydro One can now identify opportunities to reduce the cost of funding faster and more efficiently. In short, “price tension” in markets, benchmarks, historical data and investor sentiment can now be identified more quickly.

How Hydro One Outgrew Its Legacy Processes

Hydro One started uploading data in August 2019. At that time, the utility’s five-person treasury team was looking to improve the overall efficiency of its processes. They were experiencing information volume processing challenges and were looking for new methods to analyze fixed income markets and optimize interest costs. Hydro One was using Microsoft Excel to consolidate data and issuing bonds in Canadian dollars (CAD).

The treasury team had several key challenges to consider:

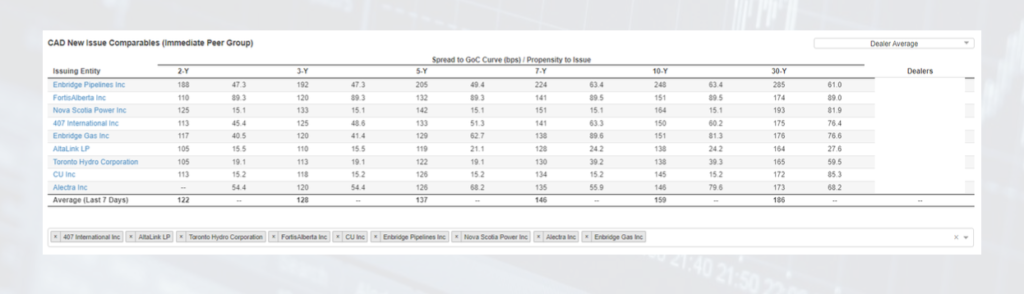

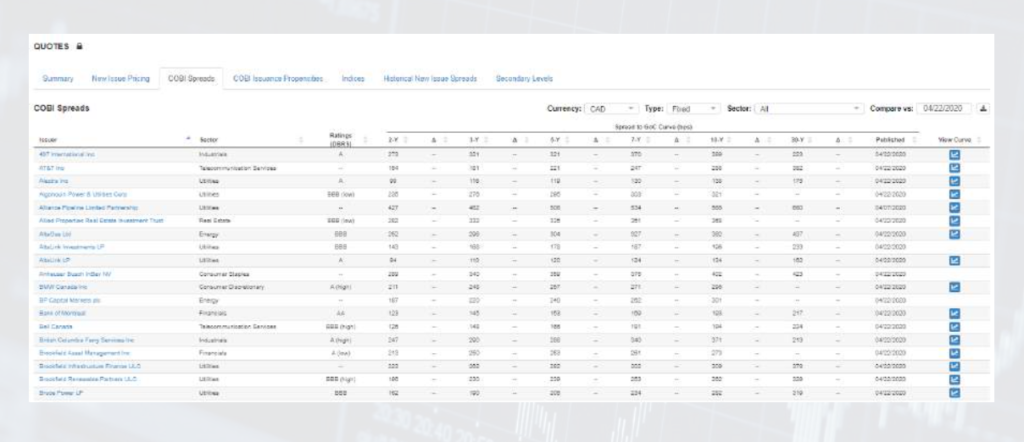

1. They needed to compare credit spreads with other regulated utilities/peers such as 407 International, Altalink, CU, Enbridge Gas and Toronto Hydro.

2. Hydro One had $1.15 billion in debt maturities in the next twelve months and typically issues $1.0 to $1.5 billion in long-term debt per year.

3. Optimal and efficient pricing in the debt capital markets was very important as the utility projected capital expenditures on its transmission and distribution business of approximately $10 billion over the next five years. These expenditures would need to be funded in part by new debt issuance.

Immediate Benefits

Hydro One was first introduced to the Overbond Treasury Operations module in mid-2019 and saw immediate improvements in its capital markets data management, which freed up time for its treasury team to focus on capitalizing on market opportunities and corporate initiatives. Two major benefits the treasury team realized through the process were:

1. Improved pricing data for new bond issues: insightful data aggregation and sector peer comparison with predictive capabilities

2. Reduced financing risks: reduction in risk of data entry errors through automation

Going forward, Hydro One will be looking to incorporate Overbond’s COBI Liquidity scoring feature to strengthen understanding of the liquidity of their own bonds as well as their peers’ bonds in the secondary market surveillance capabilities. The COBI Liquidity module utilizes metrics such as bid-ask spreads, trade count and volume, and intraday price volatility for the wide spectrum of bonds to derive a daily liquidity score for each bond

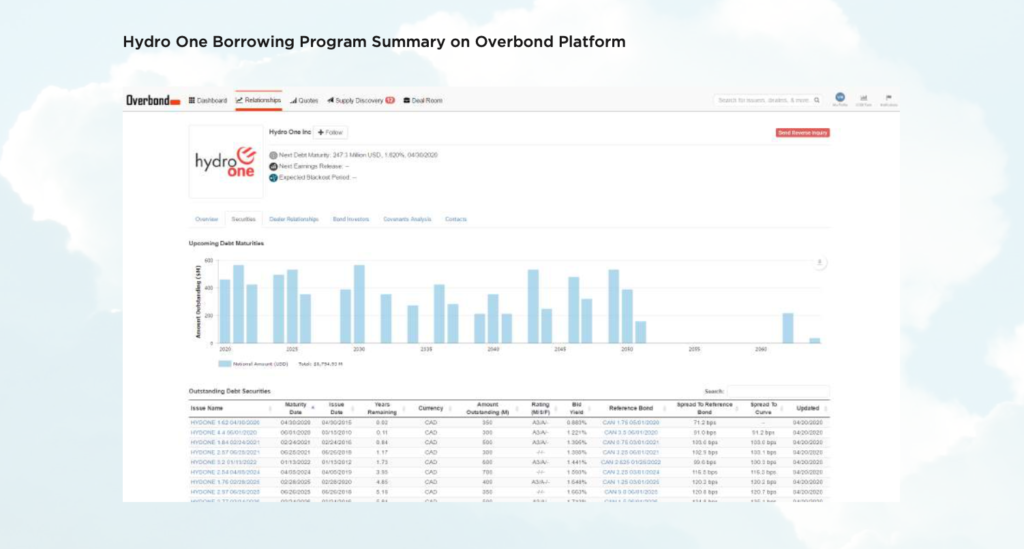

Inside the Hydro One – Overbond Portal

Overbond was able to deploy its AI-powered solution to help Hydro One aggregate data across various market vendors and data sources as well as dealer supplied runs. Overbond’s models structured, cleansed and processed voluminous data and mapped the data to the Reference Master. Subsequently, various AI-powered pricing algorithms operated on the reference master to output all modeled benchmarks and generated automated reports on a scheduled basis.

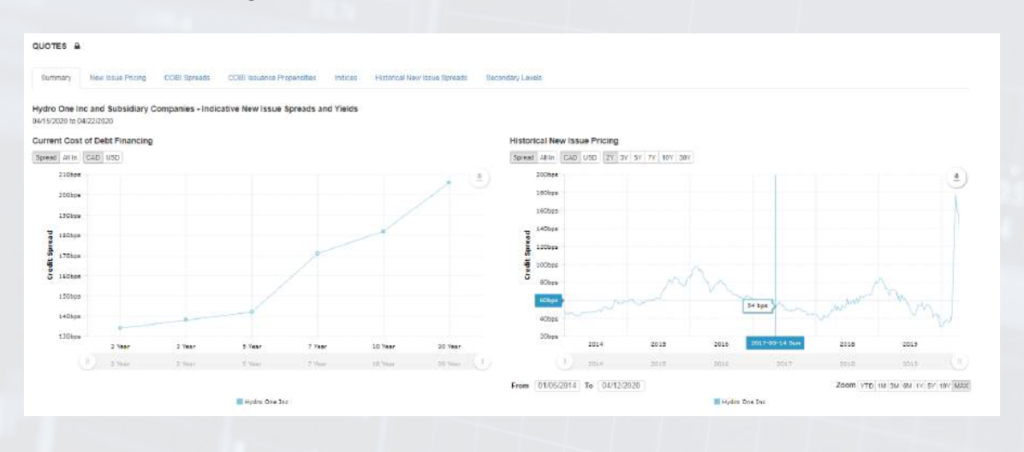

Highlights of Hydro One – Overbond Features:

1. Auto-reports and CAD pricing summary by contributing dealer, current and historical

Improved access to CAD FXD and FRN Pricing provides Hydro One better understanding of current and historical borrowing cost.

2. Comparison of new issue spreads across the peer group companies and indication of their propensities to issue bonds in different tenors

Improved access to comparable pricing and issuance propensities provides Hydro One a better understanding of the pricing position in the industry.

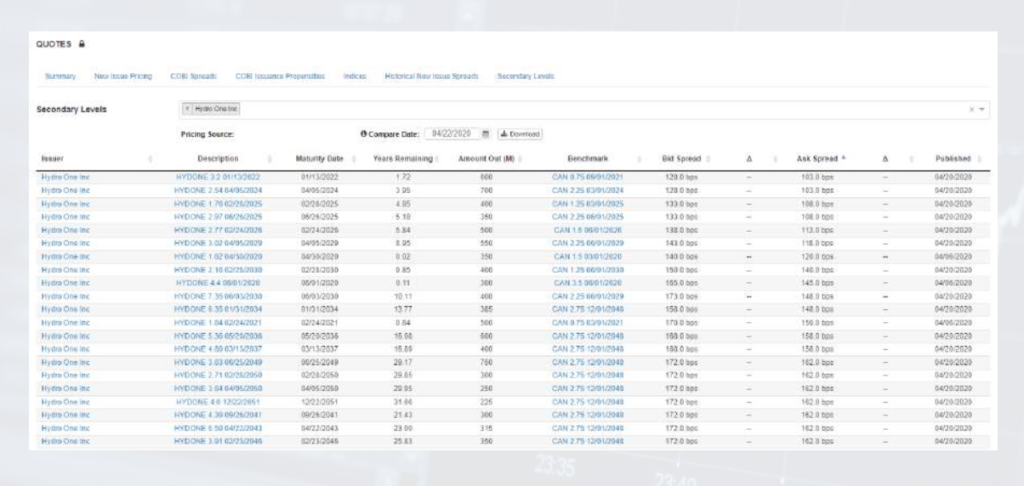

3. Data aggregation of all Hydro One bonds secondary pricing levels, peer group secondary bonds pricing levels, organized per underlying data source

Improved access to secondary credit spreads from different dealers as well and market data sources enables Hydro One Treasury to better gauge the prices of the secondary bonds when pricing a new bond issue.

4. COBI Pricing AI by Overbond handles the problem of sparse bond transaction data, especially in times of great volatility and price shifting

Model optimizes across data gaps with balance sheet fundamentals and applies deep historical benchmarking and curve fitting. COBI Pricing AI builds curves systematically for 10,000+ issuers in various real-time liquidity scenarios to arrive at best executable price. AI pricing offers Hydro One diversified way to understand the market.

About Overbond

Overbond specializes in custom AI analytics development for clients implementing risk management, portfolio modeling and quantitative finance applications. Overbond supports financial institutions in the AI model development, implementation and validation stages as well as ongoing maintenance.

Contact

Vuk Magdelinic, BASc., MBA

Overbond | CEO

+1 416-559-7101

vuk.magdelinic@overbond.com

Justin Hui, CFA

Overbond | Sales Manager

+1 (289) 544-7975

justin.hui@overbond.com