Source: Overbond

Fixed Income Artificial Intelligence

The financial services market is embracing digital processes and artificial intelligence applications to streamline business. Bond origination and OTC trading are one of the few areas which have a great need to embrace the trend. The current fixed income capital market data flows are inefficient in many respects, limiting precision in assigning value to credit risk long term. Markets remain heavily reliant on segregated and manual data operations between counter-parties and consequently, disparate data sets. These disparate data sets cause the market to suffer from information asymmetry and decentralization. As a result, insight from available data is fragmented and disseminated through manual exchanges between counter-parties, which furthers creation of disparate data sets.

Need for centralization of information

There is a great need for a fixed income big-data centralization where advanced analytics such as price discovery, liquidity risk management, intelligence gathering, pre-trade and post-trade analytics can be performed globally – to increase the overall efficiency of the fixed income market and understanding of the credit risk valuations. With no centralized hub, issuers and investors operate with partial awareness. AI application utilizing deep historical data records of fundamental data elements (audited statements, dealer supplied primary and secondary bond price quotations etc.) and secondary market bond transactions can solve this problem. With this, Overbond pioneered to be the first to market with a centralized big-data hub powered with AI capabilities for fixed income analytics.

Overbond AI Focus Areas:

Predictive Issuance Analytics – Proprietary machine learning algorithms systematically identify highly likely new bond issuance globally, providing exclusive pre-issuance insights into the fixed income market, identifying new-supply unidentifiable by prior analytical methods.

Price and Cost of Swap Monitoring – Price analytics in different liquidity buckets and integrated machine-learning modules provide a reduction in credit pricing risk, enabling systematic monitoring of credit pricing in all G-10 currencies, covering large universe of issuer names as well as monitoring of the cost of swapping proceeds from foreign currency to domestic currency.

Market Opportunity Discovery – Algorithmic matching of target institutional buyers with fixed income new issue opportunities, based on past buying patterns, portfolio manager preferences, rebalancing events and preferred industry sector, rating or tenor. Algorithms analyze deep historical buying patterns to identify traditional and non-traditional investors for each fixed income market opportunity.

AI Powered Issuance Prediction

COBI – Bond Issuance International AI was created as part of Overbond’s suite of predictive algorithms for the fixed income capital markets. It predicts the most optimal indicative new issue, its bond price as well as relative value secondary market bond price for global IG and HY issuers globally, utilizing machine-learning (ML) algorithms. The ML algorithms analyze millions of data points related to factors such as secondary levels, recent indicative new issue price quotations, foreign exchange swap costs, company fundamental data elements, investor sentiment and sector comparable. Additionally, the model scores secondary bonds across all G-10 currencies and prices the cross-currency basis swap in all G-10 currency pairs. The total cost benefit is optimized to find cheapest issuance/purchasing price and location.

AI Advantage over Statistical methods

COBI – Bond Issuance International AI modeling techniques share many similarities with classic statistical modeling techniques starting from the fact that they both deal with data. However, the key difference, between statistical techniques and AI models Overbond applies is in the overall depth of these approaches. While statisticians start with a set of known assumptions that are given to the model and best explain the expected behavior of the financial outcome in consideration, AI techniques rather aim at finding by themselves the method (with underlying assumptions that are unknown) that best predict the outcome in consideration going through all possible combinations of outcomes. AI is needed in situations like this, where it would be nearly-impossible for statistical quant to hypothesise and test 20+ years of market data with millions of different correlation pairs from various data families.

Clients can use issuance predictions for custom analysis

The predictive time horizon of the COBI – Bond Issuance International AI algorithm in standard use case is optimized for 4 to 6 weeks time horizon. A score is assigned for each company in each potential bond issuance tenor and currency. Scores are on a scale of 0 -100 and are relative to other issuers and other bond issuance tenors. A higher score in general means that company is more likely to issue in that tenor compared to a company or a tenor that receives a lower score. It is important to note that propensity scores are not probabilities. For example, a score of 90 does not mean that issuer is likely to issue new bond in that tenor and currency with 90% probability. It means that issuer is in the 90th percentile in a ranking against all other companies in all other issuance tenor possibilities and currencies.

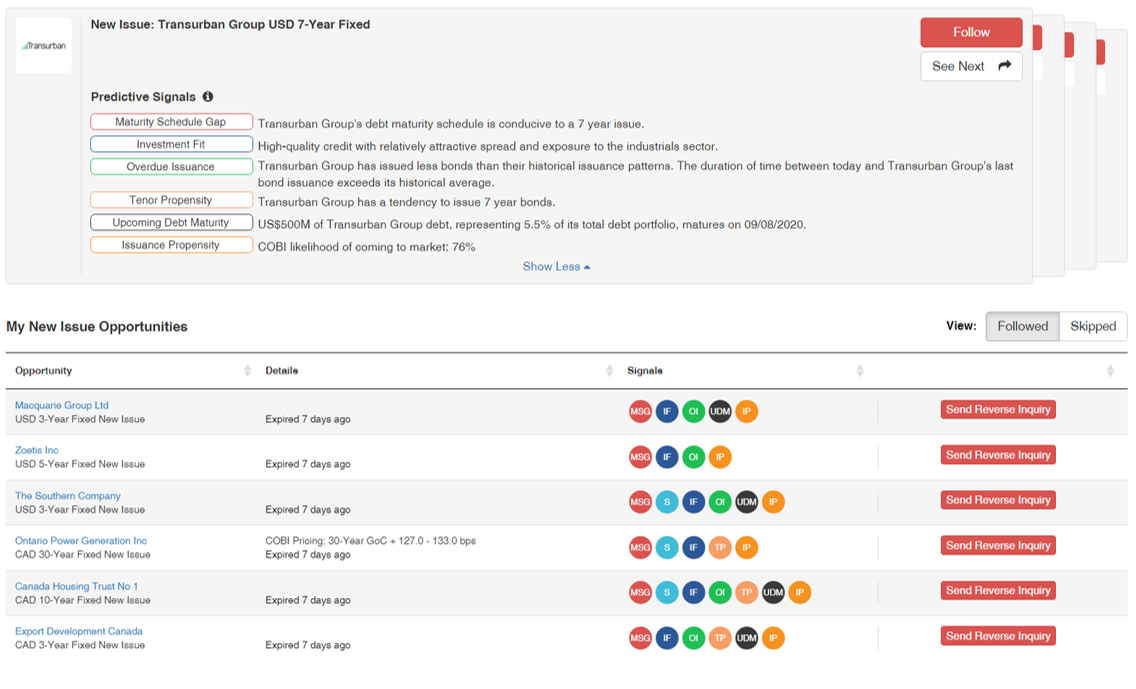

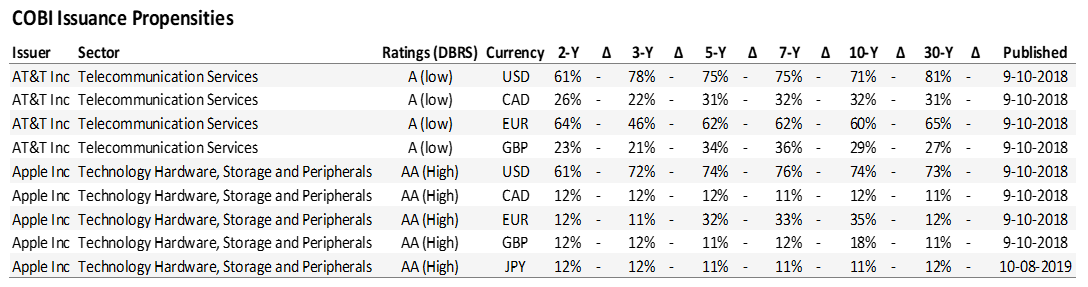

Issuance Algorithm Output

COBI – Bond Issuance International AI algorithm outputs issuance propensities for each tenor (2, 3, 5, 7, 10, and 30 years) for each issuer and in each currency that they issued in before. COBI-Issuance propensity score represents ‘Likelihood To Issue’ in next 4 to 6 weeks and is outputted with strongest underlying market signals that contributed overall to algorithm issuance recommendation. Below is an example of an output issuance recommendation for one issuer, exposing underlying feature importance (reasons why model assigned high score to this issuer, tenor and currency combination). Further below is the sample dashboard for tracking multiple issuance opportunities on Overbond cloud platform and a sample of the table nomenclature exposed via Overbond API for continuous data download.

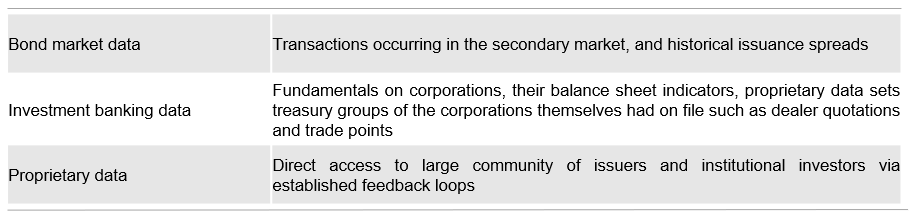

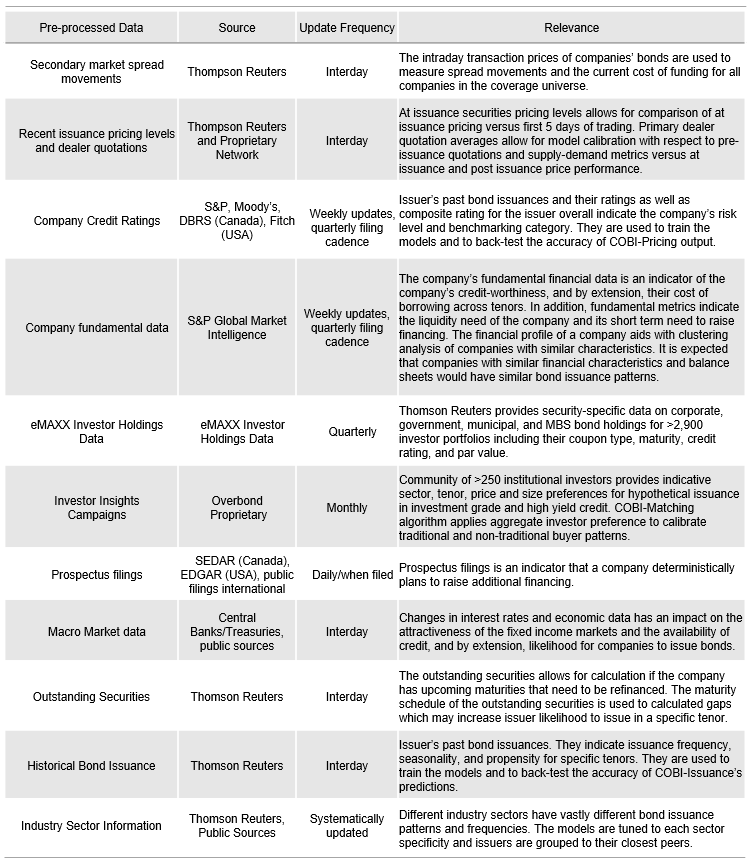

Data Intake

Data intake and processing is the integral part and critical dependency in producing accurate model output. Data families consumed and pre-processed by COBI algorithms are listed below:

How International Bond Issuance Algorithms work

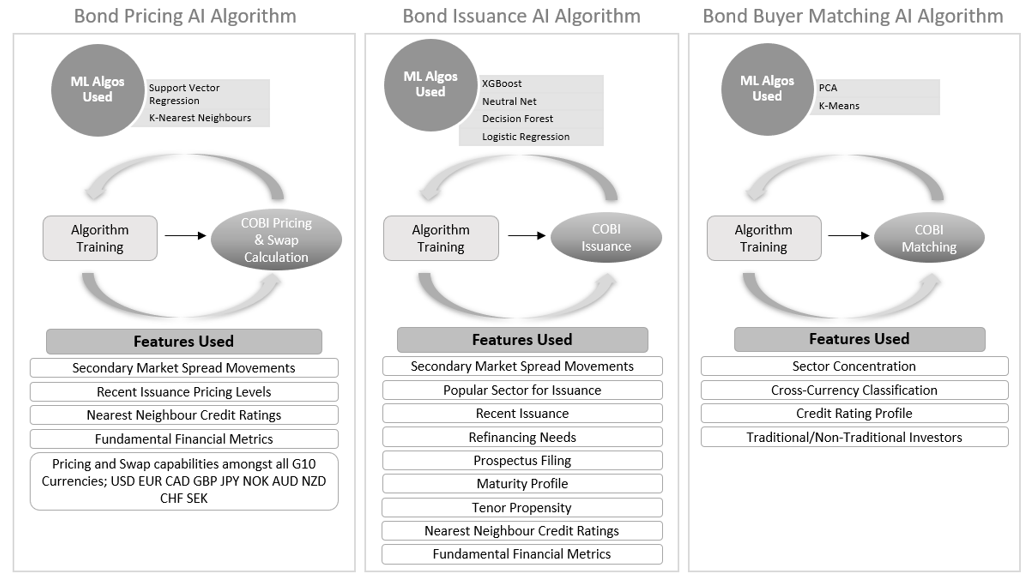

The diagram below and the following pages provide a description of how the Overbond COBI-Bond Issuance International AI algorithms work.

Model Training – Pricing

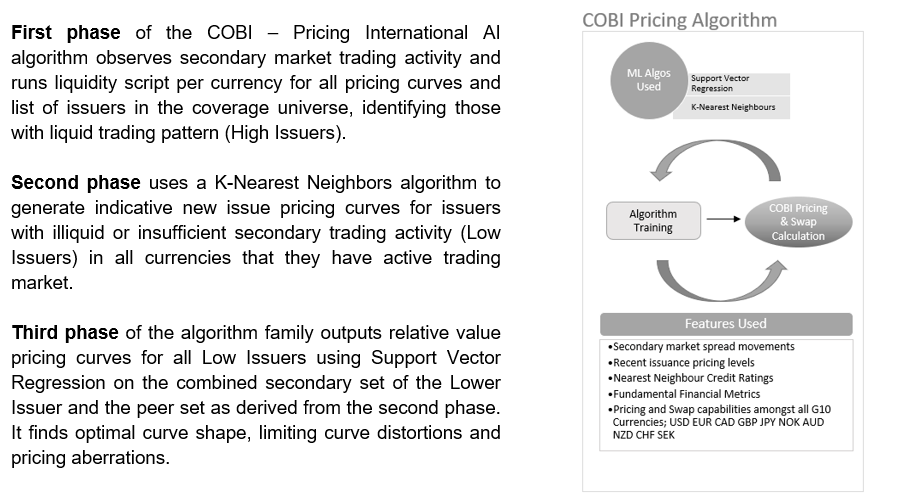

The subsequent stage after data intake and data pre-processing for the machine learning algorithms is to train and apply several models to calculate the output propensities and investor match scores. An Ensemble Learning strategy is used, meaning multiple models are combined to elevate overall robustness. The results are back-tested against the entire ten years of data. First stage of model training is applying COBI – Pricing International AI algorithms and data.

Bond Pricing International AI

COBI- Bond Pricing International AI is an advanced three-phase AI algorithm engineered to measure best-fit correlations with respect to company fundamental valuation and secondary market pricing for their bonds across sector peers and markets conditions at large and build relative value pricing curves in all G-10 currencies that issuer has bond denominated in (USD, EUR, CAD, GPB, JPY, NOK, AUD, NZD, CHF, and SEK). Models are tuned for different liquidity scenarios. A variety of pre-processed inputs flow into COBI-Pricing International AI algorithms, to generate bond pricing output. Three main phases on this algorithm family are summarized below.

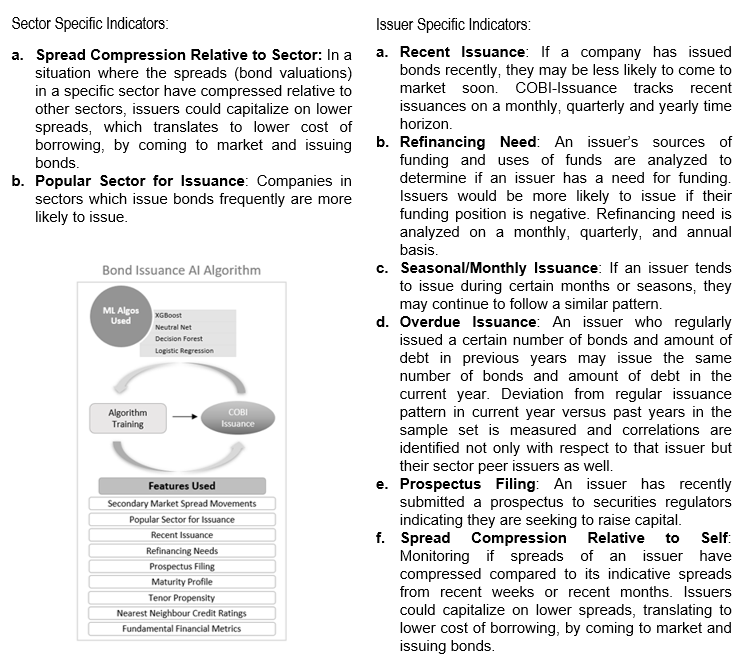

Model Training – Issuance Pattern

As a next step, COBI – Bond Issuance International AI algorithms incorporate COBI – Issuance model capabilities that profile and identify various issuance patterns across global issuers in all G-10 currencies. Models are each trained using a subset of the past data, ranging from one month to a maximum of ten years. Advanced sampling techniques are used to account for class imbalance between positive (will-issue) and negative (will-not-issue) predictions. The following is the subset of indicators used:

Within the COBI Issuance model family, multiple supervised machine learning algorithms are trained using past data to predict issuances The algorithms used include XGBoost Neural Network, Random Forest, and Logistic Regression. COBI Issuance algorithm family uses a robust ensemble method to combine the results from each sub-algorithm and generates an output score. This score represents the propensity of an issuer to issue a bond in a specific tenor and currency.

Model Training – Buyer Preference

Investor preference and local market buyer depth is incorporated as the third step of the COBI – Bond Issuance International AI algorithm family by applying COBI – Bond Buyer Matching algorithms. Feedback loops for machine learning have been established through investor insights campaign that runs monthly and sources on average 4 billion USD in non-executable investor credit preferences (across corporate, sovereign, supra-sovereign, municipal and provincial issuer credit).

COBI-Matching ranks each investor depending on their likelihood of investing in a security in each currency with the predefined criteria. The ranking is based on the quantity that the investor holds ie. dollar value of the current amount in their holding account. Further the ranking is based on the number of prior transactions in relevant transaction category, and notional size of purchasing activity. The investor rank (outputted as number of stars beside investor organization name) represents the quintile in which the investor ranks after COBI-Matching ranking algorithm finished the analysis (i.e. an investor in the upper quintile will show five stars while an investor in the lower quintile will show one star).

Back-Test Results

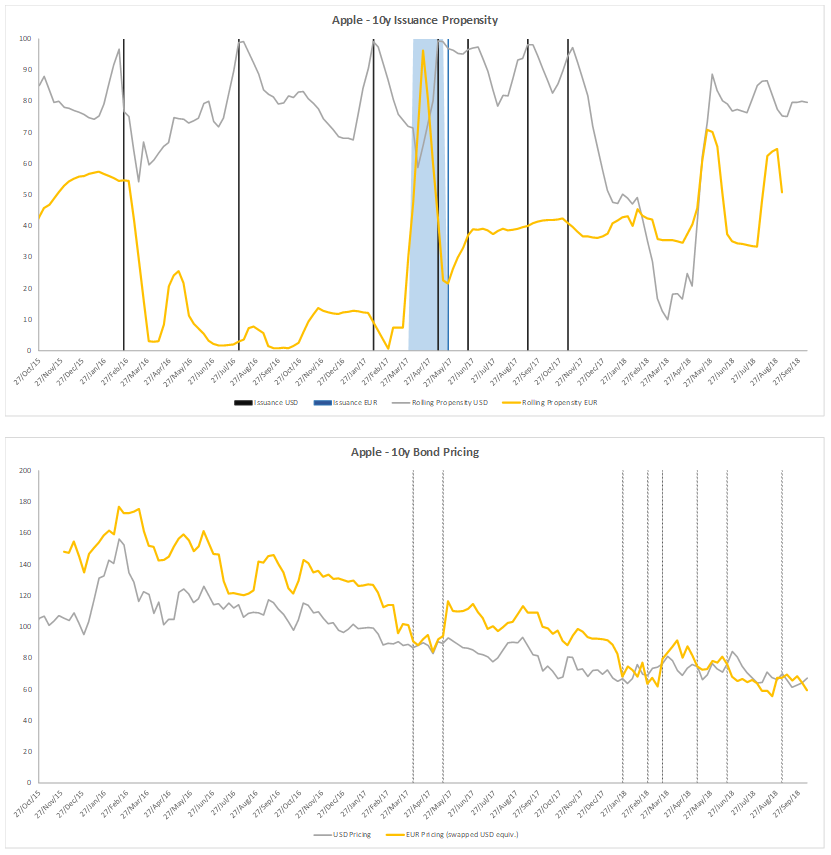

The back-test of COBI – Bond Issuance International AI algorithm can be seen in the following graph, plotting predictions time-series for a specific issuer to issue bonds in a specific tenor and a specific currency. Propensity “likelihood to issue” values are plotted over time, with black bars representing when actual issuances have occurred. The other cross-currency graphs show the benefit forgone for not issuing in other currency (in yellow). The default time horizon for the COBI-International propensity prediction is 4-6 weeks in advance. Hence, the black vertical lines and 4-6 weeks trailing area before each actual issuance on the first graph indicate issuance prediction time window. This can be adjusted according to client needs. In the below specific example, models correctly predicted Apple 10-year bond issuance in EUR.

Business Impact

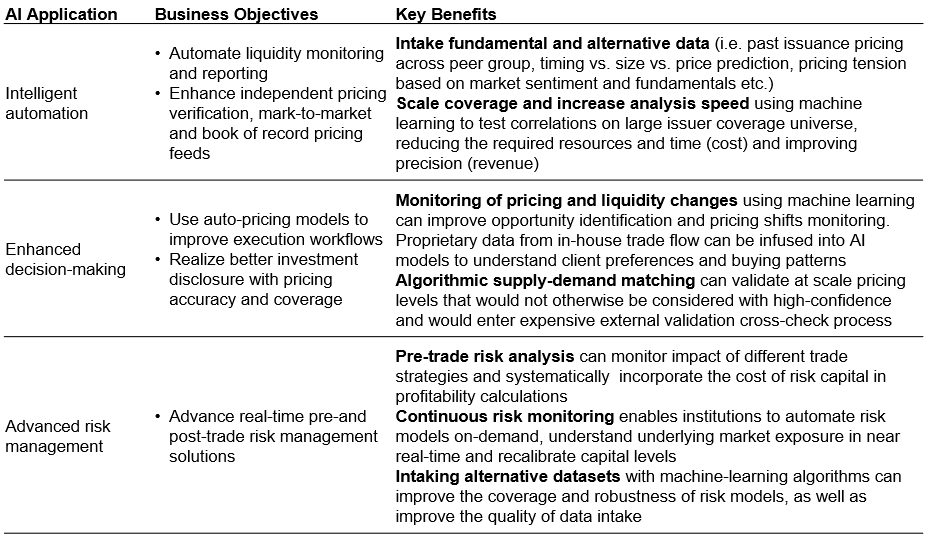

Over the past two years, we have witnessed profound changes in the fixed income marketplace with counterparties increasingly adopting quantitative investing and liquidity risk monitoring techniques. These include systematic alpha and algorithmic trading, liquidity risk management strategy and reported thresholds, merging of fundamental discretionary and quantitative investment styles, consumption of increasing amounts of alternative data, and adoption of new methods of analysis such as AI analytics like COBI – Bond Issuance International AI algorithm.

Specific use cases for COBI – Bond Issuance International algorithm application are examined to identify business objectives and key benefits below. Overbond client organizations include Tier 1 sell-side global financial institutions, buy-side institutions with over $2 trillion of assets under management globally, across both passive and active strategies as well as corporate and sovereign issuers with global issuance profile. Their innovation groups actively explore new technologies that can serve as the catalyst for innovation and improve risk management, issuance or trade flow, pre-trade and post-trade analytics.

Implementation Considerations

Institutions considering AI predictive analytics implementation and big-data transformation projects, can employ acceleration utilizing externally calibrated models and market signals. Below are several key considerations and questions for executives in charge of AI roadmap:

1.What is the current state of our fixed income in-house data?

2.What are our data science and engineering capabilities?

3.Are we building AI capabilities to grow revenue or cut cost?

4.How can we redefine the boundaries of our data universe or identify alternative data sources necessary to feed AI engine?

5.Given that AI learning curve is steep where do we begin?

6.How do we create and execute AI proof of concept use cases rapidly?

7.What are key success factors for our AI roadmap?

Custom AI Services

Overbond works with clients to identify and recommend practical AI analytics use cases that are aligned with strategic goals of the financial institution. We help assess current-state AI capabilities, and define roadmap to help clients realise value from AI applications. We manage cross-channel data flows across multiple systems and enable custom font-end visualizations.

Proven Methodology

With our targeted approach and implementation methodology, we quickly demonstrate value of AI analytics to test use cases, enabling client-side change management approach and stakeholder buy-in.

Operational Acceleration

We help clients build and deploy custom AI solutions to deliver proprietary analytics and tangible business outcomes. Our experience combines calibrated models, design patterns, engineering and data science best practices, that accelerate value and reduce implementation risk.

AI Analytics As-a-Service

Overbond helps customers design and oversee mechanisms to optimize and improve existing fixed income credit valuation, issuance and pricing prediction and pre-trade opportunity monitoring using AI. Our team of world-class data scientists and engineers manage an iterative implementation approach from current state assessment to operational handover.

About Overbond

Overbond specializes in custom AI analytics development for clients implementing risk management, portfolio modeling and quantitative finance applications. Overbond supports financial institutions in the AI model development, implementation and validation stages as well as ongoing maintenance.

Contact:

Vuk Magdelinic

Chief Executive Officer

+1 416-559-7101

vuk.magdelinic@overbond.com