Thus far, 2022 has accelerated many of 2021’s most significant trends. Inflationary forces have risen even higher, while bonds have cratered under higher rates. As of two weeks ago, the global bond index declined $2.6T, and corporate bonds have lost a staggering $1T in value. The “safe” primarily U.S. Treasury bond ETF (NASDAQ:BND) has declined by 7.3%, while the S&P 500 has dropped 6.7%. Many pensions, hedge funds, and retirement portfolios are heavily invested in sovereign and high-grade corporate bonds, so this trend will undoubtedly impact the financial economy.

I have been a long-time bear on the bond market for over a year, having covered BND last in January in “BND: The Federal Reserve’s Tightrope Could Prove Disastrous For Bonds.” The popular bond ETF has declined by an additional 6% since then. More importantly, the pace of its declines seems to be accelerating despite the significant jump in yields, implying very few private investors are willing to dive into bonds. As long warned, the impact of rising inflation has turned “safe” bonds into potentially toxic assets for most investors’ portfolios.

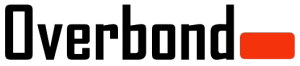

Still, historically speaking, the current bond market crash is far more extensive than is typical. Of course, this anomaly stems mainly from the fact that high-grade bonds have been immensely influenced by the rise and fall of Federal Reserve purchases via Q.E. The onset of Q.E. led to a massive surge in the bond market (or a decline in rates), and unsurprisingly, the end of Q.E. has led to a substantial bond route. However, BND is now back at its long-term support level, implying that the bond market route may end soon or become much larger. See below:

BND is now trading at the same price as its 2018 low. Historically, the fund has bounced back up soon after crossing around $80. Often, if assets fail to mean-revert after reaching support levels, they can decline at an accelerating pace as many investors race to exit the investment. While inflation has made mainstream headlines, the large crash in bonds has thus far only been publicized in financial circles. Considering many private investors in bonds check or change their portfolios once or twice a year, many (though likely few readers) may also not be aware of portfolio losses stemming from the bond market’s crash.

Are Interest Rates Truly High?

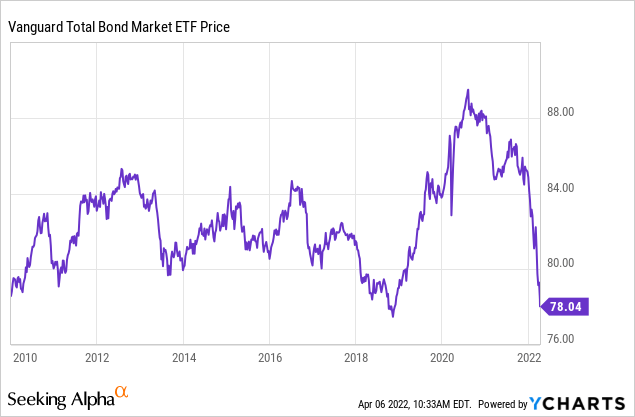

When Vanguard last updated the data at the end of February, BND had a yield-to-maturity of 2.3%. Based on the rise in medium-term Treasury rates since then, this figure is likely closer to 2.6% today. Two-thirds of the ETF is invested in U.S. government Treasury bonds, and the remaining portion is in “investment-grade” corporate bonds, albeit “bottom rung” corporate bonds with single-A to BBB ratings. The fund also has an effective maturity of 8.9 years, so its actual yield is roughly equivalent to that of a 10-year Treasury. Of course, it is slightly higher due to its corporate bond holdings (as investment-grade corporate bonds always pay slightly more than Treasury bonds).

On the one hand, Treasury bond yields and corporate bond yields are decently above their ten-year average. If you had purchased BND when its effective yield was as high as from 2010 to 2018, a decent return would have been made. Some see this as implying BND is now a bullish opportunity since it is again “trading at a discount.” However, when we account for inflation, it is clear that BND’s real yield (after inflation) is at an all-time low. See below:

In my view, investors should pay very little attention to fixed yields from a historical standpoint since rising inflation makes BND’s realized yield very negative. BND would need to pay around 5% more for the ETF to offset rising inflation and more after accounting for taxes. Problematically, BND also has a 6.8-year duration, meaning a 1% rise in its yield would cause the fund to decline by 6.8%. If BND’s yield were to rise by ~5%, as is necessary to offset inflation, the fund would decrease by ~30%. This estimate does not consider the fact that commodity forces may push inflation higher, and, in the long run, any bond with risk (and taxes) should pay a higher yield than in inflation.

Inflation May Not Be Controlled

Put simply, BND needs to decline by a seemingly unsensible degree for its yield to be closer to inflation. Vanguard ranks BND as a “level 2/5 – low-risk low reward” asset, just higher than a money-market fund that would be given a “1/5” risk ranking. While it is undoubtedly true that BND is a “low reward” asset, it is most certainly a materially high-risk asset in today’s environment. Vanguard should not be faulted for this as, since the 1980s, long-term bonds have been exceptionally low-risk assets that have delivered steady long-term returns to investors.

However, inflation slowly fell from double-digits to essentially zero from 1980 to 2020. Since 2021, inflation has rapidly risen back toward double digits, making bonds very dangerous to own, given the immense duration risk that occurs as yields are low. Up until recently, many people believed that inflation would soon decline back to “normal” levels after the “temporary” impacts from global COVID restrictions were ended. Today, this appears to be highly unlikely as movement prohibitions have returned in Asia (the primary supplier of U.S. goods) and the situation regarding Ukraine has exaggerated commodity shortages.

The Bottom Line

BND is now at a firm support level and is paying the highest yield in years. Indeed, if inflation were in control, I would be very bullish on bonds today. However, based on all the data and trends I watch, it is apparent that inflation is not under control. Further, while BND’s yield is historically high, its inflation-adjusted yield remains near all-time-lows.