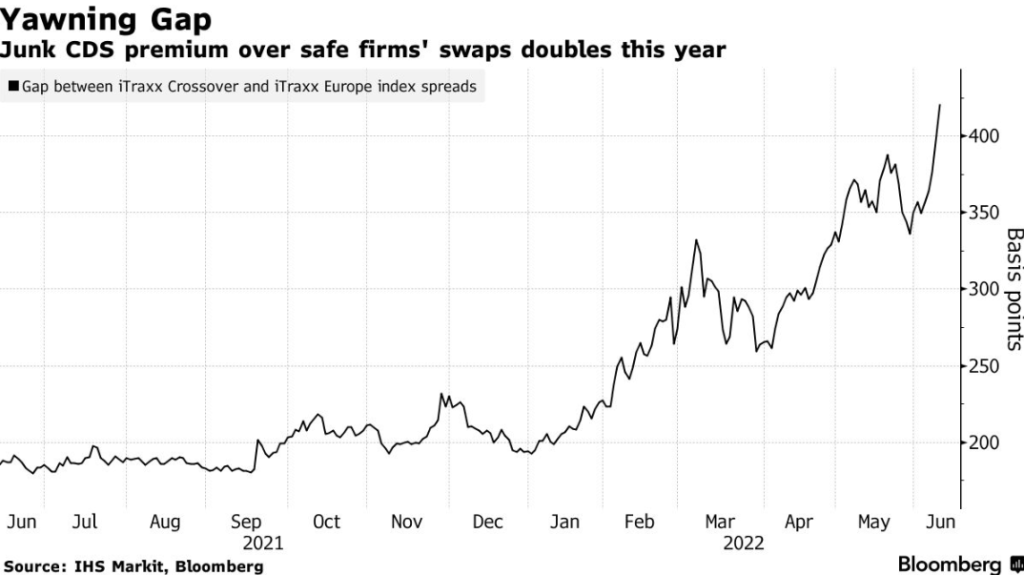

A key indicator in Europe’s credit market is signaling that there’s trouble ahead for junk bonds.

The European junk and high-grade CDS spread near the widest since 2020. According to IHS Markit indexes, the extra cost to protect against risky corporate bonds has more than doubled since last year. Kamil Amin, Credit Strategist, UBS AG said: “Increased demand for credit hedges from credit portfolio managers and macro investors has contributed to the decompression. There is concern about EU growth, more so now given inflation dynamics.” As risk of recession mount, junk rated bonds face falling incomes while borrowing costs simultaneously increase, leading to a greater risk of default. Deutsche Bank estimates default rates in Europe to quadruple by the end of 2023.

The chasm — now at the widest since May 2020 — underscores anxiety among investors as fears of recession in Europe and the US mount. Traders are betting that the Fed will raise rates by 75 basis points at least once in the next three meetings. In Europe, wagers on two 50-basis-point rate hikes by the ECB is causing a slump in bond prices.

With the risk of stagflation mounting, junk-rated corporates face the prospect of falling income and higher borrowing costs simultaneously, which could hamper their ability to repay their debts. Deutsche Bank estimates that default rates in Europe for junk will roughly quadruple to 3.8% by the end of 2023, and soar to 6.6% the following year.

That said, Europe’s long running issue with liquidity has been a saving grace for corporate bonds. Instead of selling bonds frantically, investors are turning to the CDS market to hedge against risks, according to UBS’s Amin.

Still, it’s been a difficult year for credit, with losses across most major markets in the double digits. The European Central Bank’s decision last Thursday to stop adding to its quantitative easing programs from July and raise interest rates thereafter adds to the pain.

Read More: Credit’s Rout Is So Severe That Double-Digit Losses Are the Norm

“Last week’s hawkish ECB statement is likely to continue to weigh on sentiment in European credit,” UniCredit SpA analysts led by Tullia Bucco wrote in a note on Monday. “Thus, we are likely to see credit investors preferring quality, with high-grade corporates and SSAs outperforming, and high-yield and hybrid credit underperforming.”

Elsewhere in credit markets:

EMEA

Europe’s primary bond market stayed quiet on Monday as asset prices plunged across the board. The number of zero-sales days this year has already exceeded last year’s total and is fast-approaching the 2020 record.

- Still, activity may soon pick up as market participants had expected a busy start to the week for issuance, ahead of interest rate decisions by the Federal Reserve and the Bank of England

- Bpifrance will be holding calls with investors later this week ahead of a potential green bond issue

- Intesa Sanpaolo bondholders rejected amendments to the terms of an additional tier 1 note that would have introduced the contractual recognition of a bail-in clause

Asia

Asian dollar bond spreads widened while new issuance ground to a halt, after the latest US inflation shock renewed concerns about a more aggressive Fed.

- Two-year US Treasury yields surged to a 15-year high after data showed that US May consumer prices climbed to a four-decade high, prompting traders to price in expectations for half percentage-point rate hikes at the Fed’s June, July and September meetings

- Barclays Plc became the first major bank to predict Fed could raise rate by 75 basis points at the meeting this week

- Spreads on US currency investment-grade notes in the region outside Japan widened at least 2bps on Monday after narrowing in the past 12 sessions

- A CDS gauge tracking high-grade dollar bonds also increased about 4bps

- Among non-dollar offerings, ASB Bank seeks as much as NZ$100m through notes due in five years, while KB Finansia and Bank Negara Indonesia eye fundraising in rupiah

Americas

Junk-bond prices could fall more this year as inflation jumps, but some of the biggest issuers in the market, including Ford Motor Co. and Occidental Petroleum Corp., could outperform by getting upgraded to investment-grade, according to Bloomberg Intelligence.

- US junk bonds are headed toward the biggest weekly loss in two months after declining for five straight sessions, the longest losing streak in almost two months. New issues are trading mostly flat amid a risk-off mood

- High new issue spreads will continue to suppress CLO refinancing and reset activity on both sides of the Atlantic, with end of year totals seen at $80 billion to $90 billion in the US and 10 billion euros to 15 billion euros in Europe, according to a report by Barclays analysts

- Atalaya Capital Management has acquired a portfolio of loans from Elm Park Capital Management and added its team to the investment firm’s operations

- A booming tech-powered method for trading bonds is cutting transaction costs by an estimated 40%, in a reprieve for money managers grappling with the volatile shift in the global credit cycle

- The premium investors pay to buy green bonds over conventional debt is not linked to the credibility of the environmental projects they fund, according to a Federal Reserve paper

- For deal updates, click here for the New Issue Monitor

- For more, click here for the Credit Daybook Americas