For years, David Horowitz at Agilon Capital was a rare breed in the bond market: a quant in a notoriously old-school business where prices were a call rather than a click away. Sixteen months of the pandemic is changing all that.

Source: Bloomberg

The work-from-home era is fueling a surge in electronic bond trading that gives the likes of Horowitz conviction a long-augured quant revolution is finally ready to sweep the debt world.

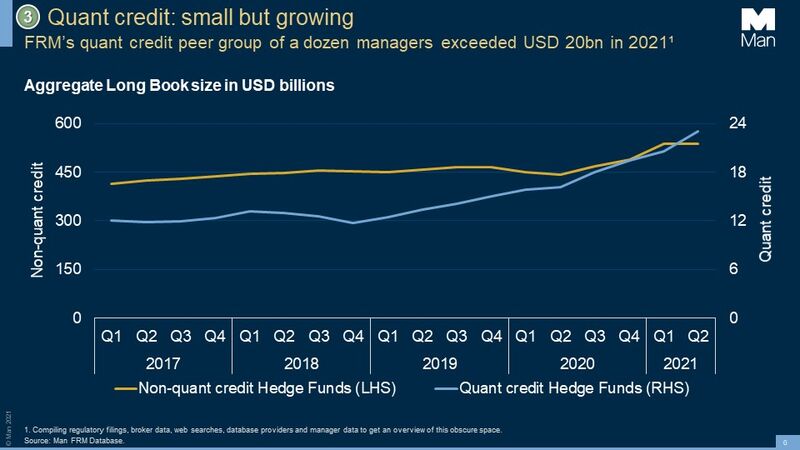

Long credit positions held by quants have doubled since 2018 according to Man Group data, outpacing the 20% growth for other asset managers as systematic players seize on the rapid market modernization — like they did in stocks years ago.

“Credit is going through a similar evolution,” said Horowitz, who led the pioneering systematic credit team at BlackRock Inc. before starting his own $290 million fund. “As we become more electronified we should expect the same sorts of forces to come into play.”

Quants have been saying that for years of course, only to have their math-based models frustrated by the cumbersome and complex debt world. The difference now is that they may have a market liquid and transparent enough to accommodate their constant churn.

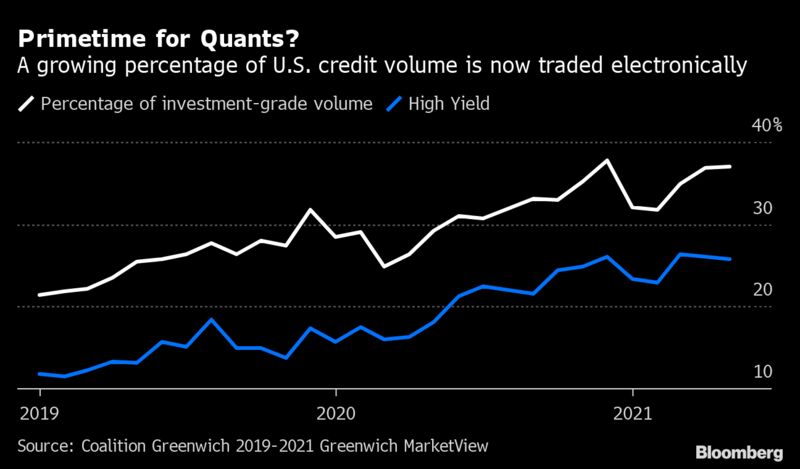

Electronic venues like MarketAxess and Tradeweb accounted for 37% of investment-grade and 26% of high-yield trading in May, 8 percentage points higher than the year before, Coalition Greenwich data show.

That sets up a virtuous circle, where banks roll out more algorithms to price more bonds. Throw in a year of record flows into credit exchange-traded funds, and a broad swath of securities is becoming easier to trade — vital for a cohort which typically holds hundreds of positions and trades more often than an average fund.

“It’s helped answer the question of ‘will we be able to trade this tomorrow?’” said Paul Kamenski, co-head of credit at the quant firm Man Numeric.

Liquidity in the bond market has long been fragmented by its very nature — companies generally issue multiple bonds. That means quants might see their models spit out a dream portfolio but have to adjust it based on what can actually be traded, Kamenski said.

“We had to try to do things that were less natural in quant strategies,” such as trading in larger sizes or catering to dealer inventories, he said. “It’s still hard today, but it’s become more manageable.”

That doesn’t necessarily mean the whole market is suddenly highly liquid — gripes about how hard it is to offload large blocks are everywhere.

But it’s become easier to move smaller sizes and figure out where each bond is trading, which helps detect signals and cut transaction costs, Horowitz said.

Over at banks’ trading desks, Asita Anche at Barclays Plc has seen a jump in algo usage, especially to execute small trades. But she stresses that humans are still essential in fixed income since liquidity is more fragmented than in equities and it’s harder to manage risk.

“The future is not algos taking flows away from humans,” said the head of systematic market making and data science. “It’s humans enhanced by algos and automation.”

With that in mind, Anche is building algos and data analytics for voice traders, and even a recommendation engine akin to Netflix’s that finds similar securities to what a client wants to trade.

Bond quants remain a tiny minority — those long positions total around $23 billion, Man Group says, versus $537 billion for other managers. And the systematic bunch operates a range of strategies, from equity-style factors like value or momentum to arbitrage or trades based on moves in an issuer’s stock.

That all makes performance hard to judge and data is scarce. A Premialab index of systematic credit strategies built by investment banks lost 5% over the past three years of rising markets and gained nearly 3% in 2021. Among global bond mutual funds, quants trailed other investors on a three-year horizon, eVestment data show.

Nonetheless, the rise of electronic trading in equities minted billions for quants and reordered the market. Many bond players are predicting a similar trajectory for their asset class, with the bonus pitch that the kind of crowding that has undermined stock strategies is a long way off.