![]() If FED follows through with the current hike plan, over 120 billion USD might be wiped out in 2018

If FED follows through with the current hike plan, over 120 billion USD might be wiped out in 2018

Source: Seeking Alpha

Summary

- US corporate debt market is highly overvalued – yields on corporate bonds are at lowest levels in 60 years.

- Corporations are not ready for the upcoming changes in monetary policy, debt servicing ratios are very high and amount of debt is ever increasing.

- If FED follows through with the current hike plan, over 120 billion USD might be wiped out in 2018.

Discussions about the most overvalued assets involve either equities, or Bitcoin. Sometimes maybe both. However, it seems that these two hot topics overshadowed the elephant in the room – debt levels and the upcoming increase in interest rates.

Data suggests that over the last few decades duration of corporate debt in the US has increased dramatically. At the same time, debt servicing ratios did not change by much. Also, the total amount of debt increased severely. All of these factors combined may have disastrous consequences, especially when FED tightens monetary policy, as described by yours truly.

Due to that investors should be very wary of holding corporate debt, especially long term, in their portfolios.

FED funds down, duration up!

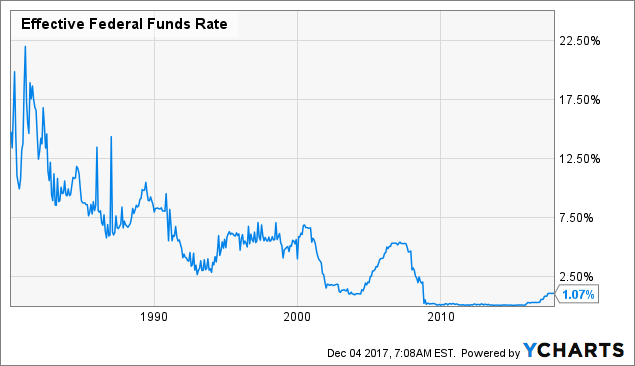

As we all know, given normal market conditions, longer duration implies larger yield. Thus historically, long maturities were rarely seen in the corporate bond market. Companies would rather issue debt for a certain project and pay the money back or refinance that debt cheaper at the end of the term. Expectations to refinance cheaper were rational while for the last 35 years interest rates have been going down:

Twenty seven years ago average duration of investment grade corporate bonds was somewhere under 5 years. Back then, according to St. Louis Fed, average yield for 5 year corporate bonds was 9.5 percent. However, over those 27 years things changed and the average duration of investment grade corporate bonds almost doubled, reaching record highs.