Adoption of automated trading continues apace across several bond markets and within different grades of instrument. Gareth Coltman, global head of automation at MarketAxess, gives traders an update on where and how they can tap into more automated bond trading, in order to deliver efficient and opportunistic execution, improved cost savings and improved desk efficiency.

Source: fidesk

How do you see automation fitting into bond traders’ execution strategy today?

Clients are recognising that the traditional way of trading leaves opportunity on the table, in terms of cost saving, price improvement and liquidity sourcing. They are building automated processes into their daily execution workflows, to catch those opportunities.

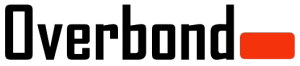

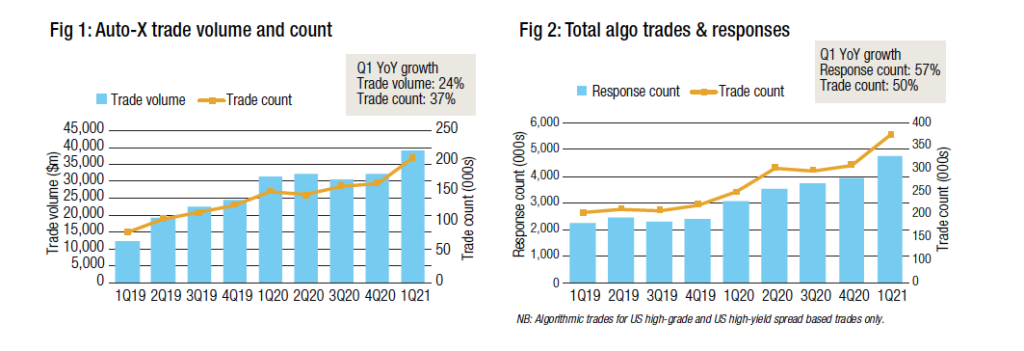

We saw good growth of automated trading into the end of last year and 2021, with trade volume on our automated execution protocol – Auto-X™ – up 24% year-on-year (YoY) for Q1, and the trade count for dealer algorithmic trading up 50% over the same period (see Figs 1 & 2 below).

The use of automated trading is dependent upon market conditions. During the crisis last year, we saw spreads widening, with high volatility. Price formation was breaking down to some degree, and although clients were still trying to use automation tools the response rates for reference pricing was not of the right level to meet their rules. After the crisis adoption returned quickly, and really accelerated into this year.

Although US investment grade (IG) credit represents the majority of automated trades on the platform, interestingly we have seen significant growth in European investment grade as well, particularly over the first quarter.

There is an expectation that the most liquid markets would be the ones which would automate first, so seeing growth in European debt, in high yield (HY) and emerging markets (EM) reaching 26% of volume in April 2021 is great.

That number is significantly higher if we look at specific cohorts of clients. Around 30 per cent of all the activity of asset managers on the platform is conducted using automation. The top 10 asset managers on average use automation for around 80 per cent of business. For some significant clients, their adoption of automation has been completely transformative in the way that they operate their execution desks.

Are the drivers different?

The biggest investment firms are focussed on and are growing passive products. Those products obviously generate a lot of trading activity, and they want to be able to manage that activity at the lowest cost base possible. For other firms it’s an efficiency play. Their trading desks are asked to process greater volumes, without any significant increase in human capital. Some clients are using automation all day long; others need scalability on the trading desk when required.

Automation isn’t just about speed and volume, then. What are the other factors that drive a specific trade towards an automated process?

A few key things are going to determine what action a trader takes. One is time. Often an order is generated and needs to be executed as soon as possible after that. However, the emergence of new protocols, like Open Trading, give the ability to move beyond being a traditional price taker. To find opportunities traders need a workflow where they have more flexibility around timing, perhaps by managing execution over a longer time horizon. A second key factor is price and price sensitivity. Some firms have significant price sensitivity and are constrained by a specific price they have to achieve, often a limit or a benchmark. Others want to get the best available price at that moment in time. If urgency is paramount, they may accept whatever the market price is now. To generate the maximum amount of price improvement, they must be flexible on timing.

Can you pinpoint the advantages that automation offers?

We believe automation is going to help clients determine the opportunities out there and then, based on constraints and sensitivity to urgency, their ambition around price improvement, to choose the appropriate protocol, and execute on an automated basis. It is not always the case that the investment decision-making process results in an order which is immediately executable.

If no one is making a price for a bond, we want automation to help find liquidity, assess the time horizon to wait to find that liquidity and look at alternatives to the bond itself. Every trader has different constraints and parameters, which can change based on the investment management process. We envisage a solution which would allow clients to set those dials and then have automation guide them through an execution process, which will be optimal based on how they have parameterised those elements.

How do you as a service provider of automation create a system which has enough dials for all of those potential clients and scenarios?

We had experience of that as we have built out our request for quote (RFQ) automation solution. We offer a whole range of parameters that allow clients to specify what is suitable for automation.

At one end of that spectrum clients want to create custom rule sets for niche parts of the market. At the other end of the spectrum clients want data to support decision-making. For example, they want support and analytics to determine when an order is suitable for execution through automation. Rather than creating a giant matrix of rules, they would like the system itself to make determinations, based on historical and current market data. That is the direction of travel over the longer term, rather than human beings creating very parameterised rules. We will always offer customisation where clients want it, but also a system that is super-intuitive about the constraints and parameters affecting a trader.

What are your plans for developing new automated functionality?

Until now Open Trading clients have been able to respond manually to opportunities. A buyside trader’s day job is not being a price maker, and opportunities could be time consuming to respond to, or even missed, if traders were focussed on executing another order at that time. Automating that has been an obvious next step. We built a tool, Auto-Responder, that allowed a client to parameterise their response. Not only to specify their own response level, but use our data, Composite Plus (CP+) in particular, to target their response and get the best chance of winning that opportunity. For example, they could peg their response around the CP+ level, whether that’s the side or the middle.

We had great feedback and engagement from a range of clients around Auto-Responder; from using it to help build portfolios, to alternative investment firms who had very proactive strategies, and used it to create alpha in those strategies. We recognised the potential not only of helping a clients to decide to automate an RFQ or respond, but also to bring that together into a tool which allowed them to move between the two in a fluid, intelligent way.