The resilience of the $1.4tn US junk bond market is puzzling investors worried about higher interest rates and an economic downturn.

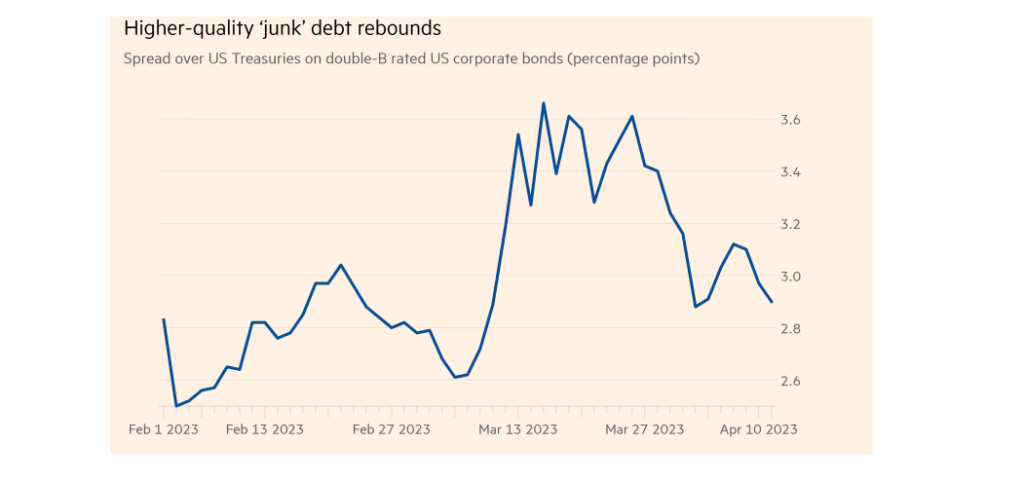

Despite concerns over the health of the world’s biggest economy, with some market indicators pointing to recession, yields have fallen since highs last autumn while spreads over government debt have tightened in recent months.

That has surprised some investors and prompted warnings that the market could suffer a one-two punch further down the road as a downturn hits earnings just as issuers have to contend with higher interest rates.

Current high-yield spreads “are an ongoing mystery”, said Marty Fridson, chief investment officer at investment firm Lehmann, Livian, Fridson Advisors.

“There’s really no evidence of the market expecting recession at this point.”

Central to the relative strength of the market is the scarcity of supply due to meagre levels of new borrowing, helped by a flurry of ratings upgrades supporting prices for existing debt.

The limited high-yield issuance follows a dealmaking frenzy during the height of the Covid-19 crisis, when companies took advantage of ultra-low interest rates to borrow cheaply and push out payment dates.

“Issuers really have the upper hand,” said Fridson. They don’t have large portions of their debt coming due within the next year or two and are not facing an actual need to refinance.”

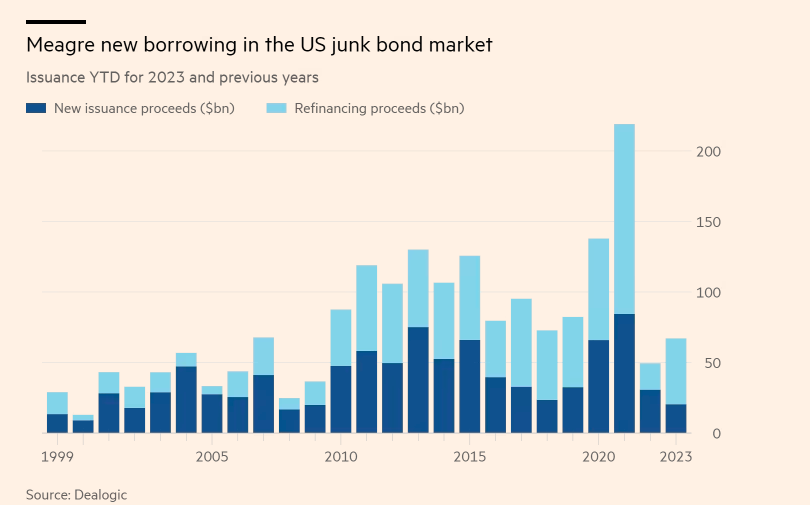

This explains the only slight increase in US junk-rated issuance this year to $67.1bn, according to data provider Dealogic, compared with rughly $50bn for the same period in 2022 when the market in effect shut down as the Fed launched aggressive interest rate rises and Russia launched its full-scale invasion of Ukraine. Full-year corporate high-yield issuance in 2022 came to just $9ibn, down from $404bn in 2021.

Sales of new bonds have picked up since April this year as the banking turmoil eased. But less than one-third, or $20.4bn, of total junk issuance since January 1 has been new fundraising rather than refinancing, according to Dealogic, the lowest proportion since 1999.

The vast majority of supply that has hit the market this year has been deployed towards refinancing – and so you’re not really adding more debt on balance sheets, you’re just replacing the old debt,” said Lotfi Karoui, chief credit strategist at Goldman Sachs.