A buy-side perspective on the electronification and automation of corporate bond trading

Why this report was written:

Buy Side Perspective On Bond Trading Automation

The fixed income markets have changed dramatically over the past decade. New regulations, new fixed income products, the rise of EľFs, and the emergence of electronic all-to-all platforms and non-dealer liquidity providers have changed the market structure.

At the same time, quantitative methods, AI, the cloud and enhanced interoperability are fostering the development and use of new trading tools and analytical capabilities. ľhe growth of electronic trading has put in place a path towards the automation of bond trading and is providing rich new data sources.

Advances in data ingestion, processing and aggregation allow buy-side firms to generate desk-level tapes in near real-time, opening up new possibilities for liquidity discovery, pricing confidence and trading analytics. Many trading desk functions, from liquidity discovery to order routing, are being automated, and the ability to fully automate up to half of all trades is imminent.

Automating functions on the desk is resource- intensive and implementation decisions can be challenging in an environment where the technology is rapidly evolving. Buy-side traders attempting to manage the automation process need to stay informed of the current state of the technology, the expectations for the future and use cases.

Why this report was written (continued):

We Asked the Buy Side about Electronic and Automated Trading

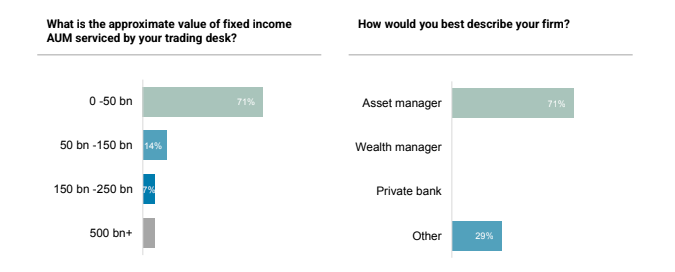

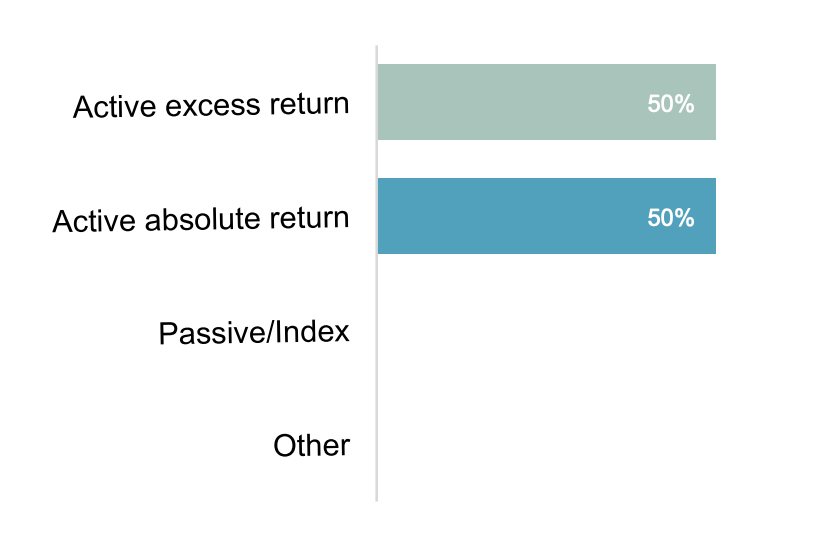

To share ideas about the ongoing evolution in the bond markets, a group of leaders from the trading desks of Europe’s largest asset managers and pension funds joined representatives from the vendor community at the exclusive Institutional Investor European Fixed Income trading Summit in Milan, Italy from March 2nd to March 3rd, 2023.

Vuk Magdelinic, CEO of Overbond, was among the three panelists sharing their insights at the session Managing data and analytics to find liquidity and control transaction costs, where participants looked at how the buy-side and sell-side capture and analyze data to search for liquidity and automate trading.

Before the session, Overbond executives, representatives from Institutional Investor and buy-side participants aligned on the set of questions designed to gauge the current and intended practices of the buy side in terms of execution, electronic trading and automation.

Slido, a slideshow presentation platform from conference software with polling capability, was used to poll attendees throughout the session. ľhe answers were tabulated and are presented below.

Key Themes Identified:

The bond trading landscape: On the road to automation

It was long thought that electronic trading of corporate bonds would be impossible. But today, electronic corporate bond trading is widely accepted and is growing. Now, traders are looking to the next frontier: corporate bond trading automation.

Significant advances have been made in coípoíate bond tíading automation and the sell-side can paítially oí fully automate up to 30% of RFQs. And it’s expected that they will soon be able to automate up to 50% of RFQs.

In addition to the development and widespread adoption of electronic trading in the corporate bond markets, automated trading is made possible through advances in AI modeling, increases in speed through cloud computing and the development of protocols to allow interoperability between various systems.

Robust data aggregation is the foundation of automation

Automating fixed income requires aggregating diverse and incomplete data sets into an accurate, single, real-time data source. Overbond is the first vendor in the industry, that provides automation which allows sell side institutions to adjust bond pricing for trade margin optimisation.

ľhe Overbond model is trained to the trading style of the desk and prices are automatically adjusted for current market conditions, including market risk and the availability of bond inventory in the market for the desired size. On the buy side, Overbond automation discovers liquidity, analyzes trading costs, splits trades and routes them efficiently. In short, this service promises to bring buy-side ľCA into pre- trade signals and enable smart order routing (SOR).

To construct a unified near-real-time data source, Overbond uses AI models to ingest, process and aggregate data from multiple sources. These include composite data feeds, transcribed data from chats and voice, records of past trades in order management systems and post-trade regulatory feeds. Neaí-real-time prices can be generated using serverless cloud computing and parallelization, which breaks up large problems into pieces that are then solved simultaneously. This aggregated data can be used by a suite of AI tools to partially of fully automate trading,

Key Themes Identified (continued):

Sell-side automation incorporating margin optimization

The Overbond margin optimization model for sell-side desks optimizes the distance-to- cover based on the best executable price according to Overbond’s pricing model,

COBI-Pricing LIVE. It incorporates variables that give insight into security, issuer and macro-level market risk and ensures that the automated margin is sensitive to intra-day risk movements.

The Overbond margin model accounts for how a desk alters margin in response to market conditions. To do this, Overbond uses a statistical technique from medical science known as case-mix adjusted cluster (CMAC) analysis to remove pricing movements related to risks at the issuer level and isolate the security-specific risk demonstrated in the pricing movement.

Trade size in relation to the amount of a bond issue available in the market is also an important factor in pricing and determining the desired margin. To address this, the Overbond margin model estimates the total market capacity (ľMC) per bond, which is the portion of the outstanding amount of a bond not tied up by buy-and-hold accounts unwilling to sell.

Buy-side automation requires smart order routing

Buy-side desks also use ľMC as part of the SOR process. ľhis is an algorithmic process that executes trades by allocating them across various electronic trading venues and counterparties based on price and liquidity to get the best execution and minimize trading costs. Before allocating a trade, the Overbond SOR algorithm determines how to split the entire trade size into pieces, which would be less efficient if ľMC is unknown.

Market risk and capacity are calculated from data available to all market participants, but desks gain their competitive advantage through the unique parameters they use to make their trading profitable. Any fully automated trading system typically incorporates these parameters. Overbond integrates desk-specific execution records into its analytics, allowing automated trading to adhere to the desk’s execution style, bias and rebalancing approach.

Key Themes Identified (continued):

Transaction cost analysis moves pre-trade

Transaction cost analysis (TCA) is an increasingly common desk-level analytic required by buy-side traders, it is also a key input in the Overbond SOR model. TCA has traditionally been a post-trade exercise, but Overbond has brought it to pre-trade.

Overbond AI generates pre-trade and post- trade transaction cost analysis by accessing the internal order management systems (OMS) and client databases of the trading desk and looking back through past transactions for similar bonds (ISIN/CUSIP).

Overbond AI looks at risk, liquidity, size, counterparty, RFQ competitiveness, dealer quotes, and inventories. It aggregates the data, determines the best executable pricing and liquidity and powers TCA pre-trade LIVE recommendations and post-trade reports. In addition, Overbond AI refreshes the entire TCA look-back for client books that can have tens of thousands of trades every two seconds.

Interoperability is critical to bringing automation to the desk

TCA, like data aggregation and margin calculation, requires the ability of different systems or programs on the desk to communicate with each other, exchange information and use that information. This is known as interoperability, and for Overbond’s COBI-Pricing LIVE to be used to automate trading, three layers of interoperability are required: it ingests and aggregate data from multiple sources, integrates with the desk systems and communicates with electronic trading venues.

Overbond’s API connections allow for internal system integration, ingestion of pre- and post- trade data from external vendors, and liquidity venue connectivity — ultimately creating a streamlined system capable of automating RFQ flow using Overbond’s AI engine.

This is what they told us:

How would you best describe your firm?

This is what they told us:

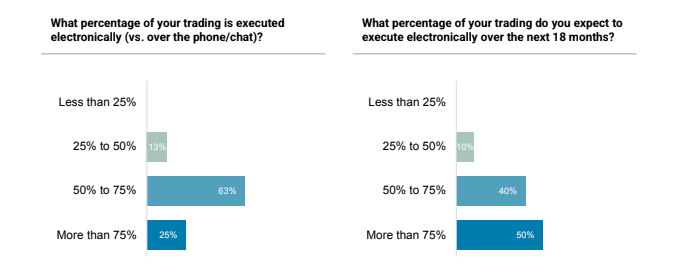

It’s clear from the attendees that the last decade has seen most fixed income managers move to electronic execution and that electronic trading is expected to glow.

Six out of ten respondents execute 50% to 75% of their trades electronically, with none executing less than 25% electronically. One in four execute more than 75% of their trades electronically rather than by phone or chat.

Over the next 18 months, 90% of respondents expect to execute more than half of their trades electronically, and half expect to execute more than 75% electronically.

This is what they told us:

What is a typical time to get a response to an RFQ?

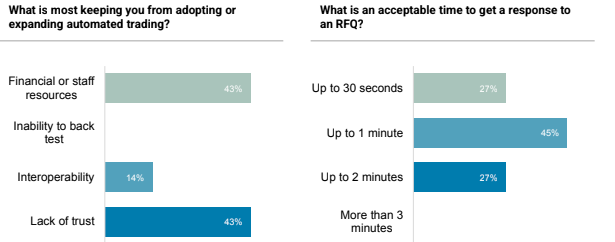

As electronic trading takes hold, automated trading can be expected to follow, but implementation hurdles remain. ľhe primary reasons desks are not adopting or expanding their automated trading are a need for more resources (43% of respondents) and a lack of trust (43%).

For sell-side traders, one of the benefits of automated trading will be to increase the speed with which they can respond to RFQs.

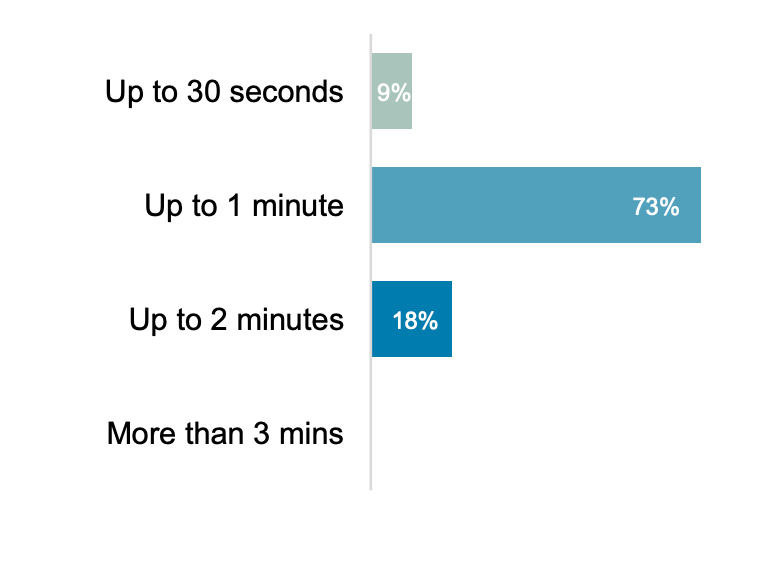

Currently, buy-side traders seem satisfied with RFQ response times, as 43% say one minute is an acceptable time for a response and 27% are satisfied with up to two minutes. Eighty-two percent report receiving a response in one minute or less.

Still, some accounts aren’t satisfied: 27% believe that responses should arrive within 30 seconds, but only 9% say this is typical.

This is what they told us:

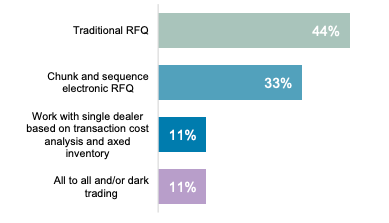

How do you manage trades that are larger than €5m?

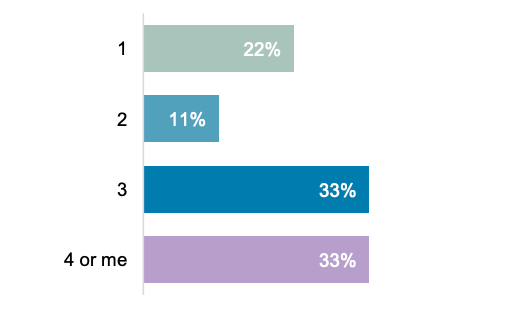

How many dealers do you split large tickets between?

While a fifth of respondents still assigns large tickets to just one dealer, two-thirds report splitting these tickets between three or more dealers.

Buy-side trading desks are looking for a signal to indicate market conditions and the best path to execution on a larger tickets. If a trade is to be split, they’re looking to analyze past transaction costs to find the dealers that have executed most efficiently with and identify dealers that might hold inventory in the desired size in the bond being traded.

New AI Algorithm Highlight: Total market capacity

Total market capacity (TMC) AI algorithm developed by Overbond is measuring total capacity in a particular corporate bond. When TMC is reached there is not enough of a bond readily available in the market to fill a trade. It’s the portion of the outstanding amount of a bond not tied up by buy-and-hold accounts unwilling to sell. Traders are likely to alter their margin for trade sizes approaching the TMC.

To train for TMC, learning and prediction are applied to six or more months of historical post-trade data to bridge data delays and discern trade size and volume patterns. For instance, by tracking what’s added daily, the algorithm uses TRACE data in USD to determine how much inventory dealers add incrementally over several months.

Knowing the TMC is valuable information for traders trying to determine prices for voice or manual electronic trades. When incorporated into automated trading, it makes pricing more precise, smart order routing (SOR) more efficient and margin calculations applicable to a larger range of trades.

SOR is an automated process used by the buy-side for online trading. It executes trades by allocating them across various electronic trading venues and counterparties based on price and liquidity to get the best execution and minimize training costs. Before allocating a trade, Overbond’s SOR algorithm determines how to chunk the entire trade size into a pieces―a process which will be less efficient if TMC is unknown.

TMC can also be a useful input when automating sell-side trading. Broker-dealers, competing to win trades in a request-for-quote (RFQ) protocol, try to minimize their margin, which is the distance of their quote from the next-best quote by a competitor (which market etiquette entitles them to know). Traders try to optimize margin to be more profitable, and they’re likely to alter it dramatically as they trade past the TMC (a key consideration in Overbond’s automated AI margin optimization algorithm).

This is what they told us:

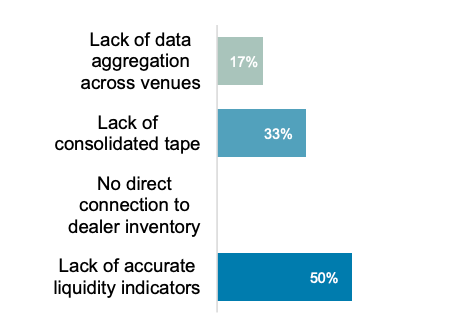

What is the biggest limitation to discovering liquidity?

It’s essential for us to have the liquidity information already in the portfolio construction process,” commented one portfolio manager for a high-turnover quant fund. He points out that it’s not exclusively for the trading side but for the portfolio construction. He explained that construction is highly automated, and sometimes it can emerge that it’s hard to get liquidity for as much as 60% of the trade list that is recommended.

But finding liquidity information is easier said than done. Half of the respondents indicated that the biggest limitation to discovering liquidity is a lack of accurate liquidity indicators, followed by a third who cite the lack of a consolidated tape and 17% who believe it’s the lack of data aggregation across venues.

Overbond is solving this problem by generating two liquidity indicators, one centered around price confidence and the other around available trading volume

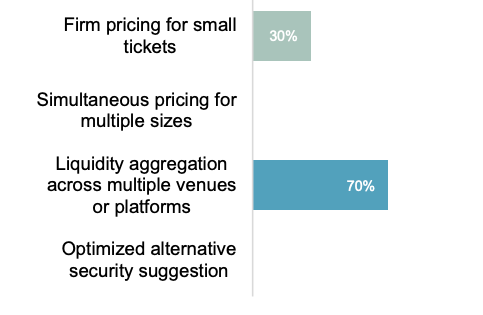

What feature would you most like to see in an OEMS?

To this end, liquidity aggregation across multiple venues or platforms is the feature respondents would most (70%) like to see in an OEMS, followed by firm pricing for small tickets (30%).

Several attendees reported frustration with the state of fixed income OEMSs. While they are well developed for equities, they are lagging for bonds. As a result, some have tried to adapt equity OEMS for fixed income and others have designed their own.

New AI Algorithm Highlight: Smart Order Routing:

Smart Order Routing (SOR) is an automated process used in online trading to quickly execute a trade based on price and liquidity across a range of electronic trading venues and counterparties. By analyzing different offers and placing optimized orders, SOR responds to the challenge of fragmented data and liquidity in the fixed-income marketplace.

It works by applying machine learning to the trading process, so each router path is configured and ‘trained’ on the data record of the previously executed transactions and the trading style and bias of the traders it serves.

SOR has been a key component of equity trading workflow for 20 years. But with AI, it can start to make decisions on which venue trades should be routed to and which dealers should be approached based on past performance and real-time market conditions. This also frees up time and resources for traders to focus on other value-added market monitoring and research activities.

SOR is the next logical step to complete this end-to-end automation.

SOR accesses a range of electronic trading venues simultaneously, quickly finds the best prices, creates a structure to customize algorithms and then helps track, validate and review data for additional controls and analytics.

The SOR engine determines which venue will be directed to activate the trade, factoring in venue liquidity characteristics and the trader’s specific price momentum and execution cost requirements. The routing logic dynamically adapts based on machine learning of the historical execution records from each specific trading venue and the quality of the available real-time market data at any given moment.

Algorithms determine the trade size, execution time and price, aiming for the best volume-weighted or size-adjusted price and trading route. An order route is dynamic, meaning it updates existing opportunities and scans for new, better ones as the market conditions.

Corporate Bond Trading Automation – The Future

Where do participants see electronic and automated trading headed?

The buy-side is still dealer reliant, but the lack of accurate and reliable liquidity indicators brings into question the pricing of large trades. Electronification is stepping forward with automation and efficiency tools looking to solve inefficiencies in the credit markets. Some pre-trade analysis exists but the next step forward will be applying electronic trading and analysis to large trades. Overbond remains focused on enabling credit trading automation and seeing that the trade size that can be traded electronically increases, but the question is how quickly. Given advances in the real-time data streams aggregation and AI algorithm applications the solution to deep liquidity problems in credit trading markets does not seem to lie in launching another new protocols or venue; instead, it’s more about the tools at the desk and buy-side solutions that will enable further automation and more efficient workflows.