Wall Street may be home to the most sophisticated and high-tech financial machinery in the world — but if you want to buy some bonds, you often have to call up an actual human on the phone.

Why it matters: That’s finally starting to change. Electronic trading has surged over the last four years in the corporate bond market, accelerated by the work-from-home disruption of the COVID era.

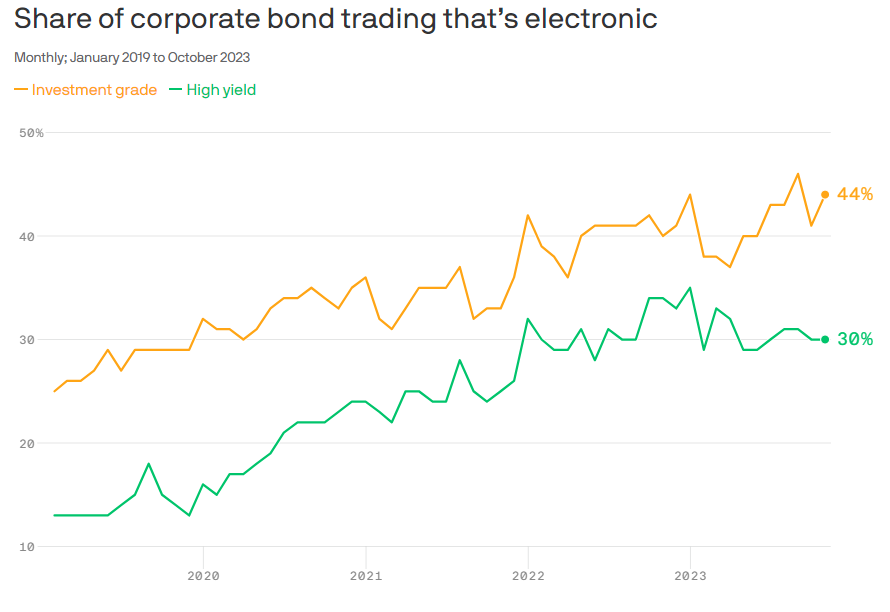

By the numbers: This year, about 35%-40% of corporate bond trades have been executed electronically, according to analytics firm Coalition Greenwich.

- That may not seem like a lot, considering that stocks have largely traded electronically since the 1970s.

- But compare that to early 2019: Back then, just 13% of high-yield and 25% of investment-grade bond trades were electronic.

How it works: In the legacy, non-electronic method, investors like mutual fund or hedge fund managers place orders via phone calls or emails to a friendly trader at one of the big banks.

- They probably have to ping a handful of traders to find one that can source the desired bonds at the price they want. This could take an hour or more, and the price could change during that time.

- Meanwhile, in electronic trading, investors use a software platform — like Tradeweb, for example — to send the order out. In a few minutes, the same trading desks can all respond with their price, and the investor can go ahead and execute the trade.

The big picture: Bonds didn’t really follow stocks in the shift to electronic trading because the market structure is completely different, says Izzy Conlin, Tradeweb’s head of U.S. institutional credit.

- Take a large company like IBM as an example. It has one common stock that trades on an exchange. But at any given time it may have dozens of different bonds with vastly different terms — and they don’t trade on an exchange.

- Moreover, plenty of bond issuances are small and not readily available in the market. (There are about 100,000 individual corporate bonds compared to less than 5,000 public equities in the U.S.)

- Even in the less varied and highly liquid Treasury market, trading is only about 60% electronic, Tradeweb estimates.

Zoom out: Proponents of electronic credit trading have been trying for two decades to gain traction, Conlin wrote in a blog published this week.

- “Progress, though, was erratic, as periods of volatility often drove investors back to familiar traditional voice trading,” she wrote.

State of play: COVID helped fast-track the recent surge — it was a time when radical changes to workflow were suddenly commonplace, Conlin notes.

- It’s also a matter of the older generation retiring, and a growing cohort of more digital-oriented millennials filling the ranks of Wall Street firms, says Conlin, a millennial, who was a trader at BlackRock earlier in her career.

The bottom line: Procuring the exact bonds you want is still often a relationship game — “the trader/salesperson model still reigns supreme,” Conlin wrote. But the big banks are adapting, and investing in electronic infrastructure.

- Electronic trades could soon make up more than half of the market, Conlin estimates.

Source: https://www.axios.com/2023/12/07/electronic-trading-corporate-bonds-share-chart