Strong flows and growing demand for market data, trading tools and protocols should increase electronification of credit markets, the laggard in fixed income, even as work-from-home norms adjust. Historically low rates and compressed spreads have driven the search for efficiency, which also favors e-trading, and a Gary Gensler-led SEC would likely push to improve credit-market transparency.

Developments since the pandemic favor more e-trading in credit. January data from MarketAxess and Tradeweb, the two biggest platforms, show strong growth in average daily volume for investment grade (IG) and high yield (HY) relative to pre-Covid-19 and year-over-year. The increase in Trumid’s volume was even stronger, albeit off a much smaller base, partly reflecting increased dealer presence in e-trading.

The massive increase in issuance last year fueled secondary-market volume in both the dealer-to-client segment and on interdealer and e-trading platforms, but recent data signal strong momentum for the latter.

It’s encouraging that electronic transactions on the foremost credit-trading platforms have not only recovered to pre-pandemic levels, but also match or exceed March values. We believe it’s an indication that market participants see benefits in both volatile and more-normal market environments. The fully electronic share of credit trading on Tradeweb is above the pre-pandemic high, while the percentage that’s electronically processed, which includes voice trading and spiked amid market volatility, has resumed its descent.

MarketAxess’ Open Trading all-to-all platform accounts for a record-high share of the firm’s credit volume. E-trading generated more than a third of the $240 billion in credit volume on MarketAxess platforms in January.

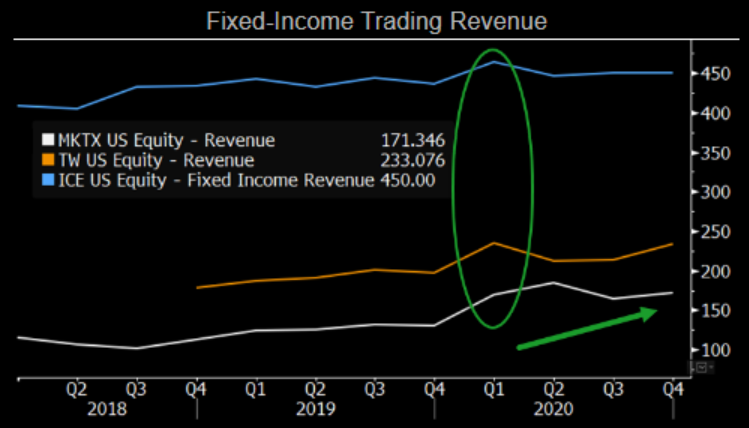

As a result of continued strong growth, the combined volume of MarketAxess and Tradeweb relative to total activity reported to Finra has risen to all-time highs in recent months in investment grade and high yield. Both firms have cited increased e-trading as the key driver and continue to invest in this part of their businesses, largely competing with each other for market share. Still, as the two largest e-trading platforms for credit their investments reflect confidence in the future growth of e-trading.

Increased interest in fixed-income exchange-traded funds is helping to drive the electronification of corporate-bond trading. Over the past year, assets in U.S. credit ETFs have grown almost 40% to more than $300 billion, while turnover (aggregate volume of shares traded) increased 32% to 180 million shares a day. As in other markets, growth in a liquid, exchange-listed instrument has brought more transparency to the asset class. Importantly for electronification, it has also spurred more demand for the underlying bonds, both through the normal mechanics of the ETF creation and redemption process and by pulling in new players and facilitating activities like portfolio trading.