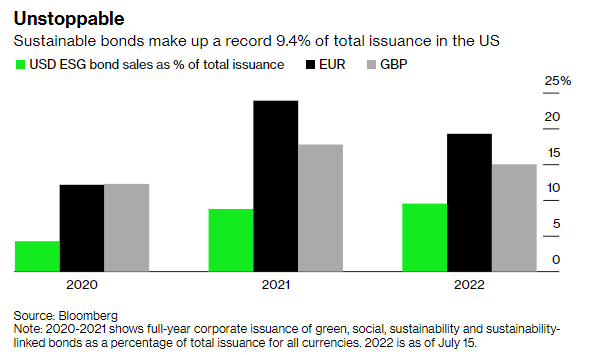

Bloomberg article highlights increased interest in ESG bonds amid credit market downturn. The market for socially responsible credit stays open while the broader primary market sinks as a result of heightening recession risks. Although volumes have decreased, issuance of ESG products are increasing, making up 9.44% of the more than $1 trillion volume of corporate bonds issued this year through July 15. According to data compiled by Bloomberg, that compares to the 8.8% of the $2.5 trillion issued through all of 2021. Trisha Taneja, Global Head of ESG, Deutsche Bank AG said “The US market is getting more developed and you are seeing more and more pricing benefits for ESG instruments, particularly for green bonds”. On the current trajectory, there is an expected increase in interest and issuance for ESG credit.

As the Federal Reserve’s tightening campaign amps up the odds of a recession and spurs global credit volatility, debt market practitioners see an enduring boom in all things environmental, social, and governance.

On the current trajectory, underwriters see scope for a busy second half for issuance.

“Lower ESG issuance has not been driven by a lack of desire to issue, but instead by the broader market slowdown,” wrote Barclays Plc strategist Charlotte Edwards in a July 8 note, pointing to the larger percentage of total corporate supply coming to the market with an ESG label this year.

Meanwhile, heightened scrutiny from the US Securities and Exchange Commission on how domestic corporations and money managers tackle climate-change risks has incentivized businesses to highlight and hit sustainability goals, according to top underwriters Bank of America Corp. and Deutsche.

“We continue to have a really strong and diverse pipeline in terms of structures, as well as sectors that are represented,” said Steven Nichols, head of ESG capital markets for the Americas at BofA Securities, the biggest underwriter of sustainable bonds in 2022. “It reflects a dramatic increase in focus on the ESG theme among the US investors, which is helping to drive an increased focus among US issuers.”

PepsiCo Inc. is the latest US business to sell ESG-themed bonds, which tapped the investment-grade market on Wednesday with a $2.5 billion three-part transaction that included a $1.25 billion green tranche. Orders for the overall deal peaked at $16 billion, allowing the issuer to pay much lower new issue concessions of between 5 basis points to 10 basis points, according to Bloomberg strategist Brian Smith. The soda giant first tapped the green bond market in 2019 when it raised $1 billion of senior unsecured green securities.

And issuance is on track to keep ramping up as the second half of 2022 gets underway, according to BofA. Likely issuers include sovereigns that are expected to debut deals later this year or in early 2023, according to Deutsche, as well as corporations in sectors more exposed to climate risk, such as natural resources, industrials and metals and mining.

The high-yield market may also be a source of increased ESG issuance, especially in Europe. At the moment, the continent is bearing the brunt of the war in Ukraine, with issuers turning their attention to immediate liquidity and funding needs instead of green and social financings, said Deutsche’s Taneja. “That’s a pipeline that’s been building up but the market has just not reopened, so really then it’s a question of what’s the right time for them to come to market,” she said.

Still, bonds tied to environmental, social and governance projects made up a 19.3% chunk of over $697 billion of all euro-denominated corporate bonds issued this year, compared to about 24% of $1.2 trillion issued last year.

Borrowers looking to save on financing costs as central banks raise rates to curb inflation are more likely to pick green bonds over sustainability-linked offerings, as the latter penalizes issuers if they fail to meet ESG standards, said Barclays’ Edwards.

As for first-time issuers, they will likely be more strategic about when they sell sustainable debt and what type of debt they want to sell, said Nneka Chike-Obi, head of APAC ESG research for Sustainable Fitch. But corporations with ongoing sustainable bond programs will also likely continue issuing debt this year, she added.

“Macro conditions are really going to be the biggest driver,” said Chike-Obi. “June was pretty active compared to the first five months of the year, so things may pick up.”