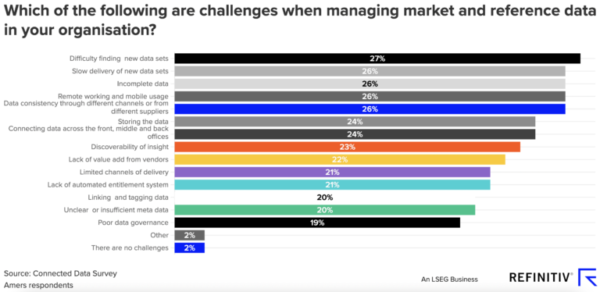

What market data strategy challenges does the buy-side face?

Although the new Refinitiv Connected Data survey shows that buy-side firms are making more progress on their digital transformation journeys than sell-side firms, the evolution of their market and reference data strategies will require much more work, respondents say. Digital transformation journeys around market and reference data in buy-side firms are being hampered by the…