Overbond Expands Primary Bond Market Deal Capabilities with Corporate Bond Intelligence and OpenFin Integration

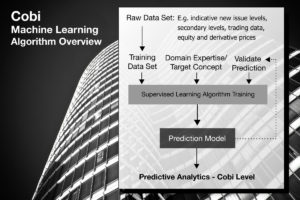

New product breakthrough applies machine learning and predictive analytics to match investors with real-time credit investment opportunities TORONTO and NEW YORK — September 12, 2017 — Overbond Ltd., the first end-to-end capital markets fintech platform for primary bond origination, has launched COBI Opportunities, a new proprietary issuer-investor matching solution for primary bond markets. COBI (Corporate…