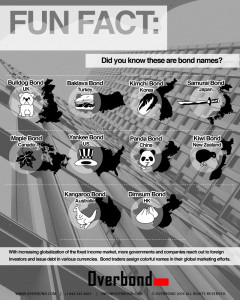

More Than One Worry Is Hitting Bond Markets

Bond yields keep going up in response to higher inflation, lower global risk, and changing central-bank policies. Source: The Wall Street Journal There is a little bit of fear creeping into government bond markets. It is about time, even if investors are still underestimating how much long-term Treasury rates could rise from here. Government bonds are…